Leasing is a common practice in business. It is a contractual agreement between the lessor (owner of the asset) and the lessee (user of the asset) where the lessor agrees to allow the lessee to use an asset for a specified period in exchange for periodic payments. Leases can be classified into two broad categories: finance leases and operating leases. Finance leases are leases that transfer substantially all the risks and rewards of ownership of an asset to the lessee, while operating leases are leases that do not transfer substantially all the risks and rewards of ownership of an asset to the lessee. In this article, we will discuss which of the following leases would not be classified as a finance lease.

What is a Finance Lease?

A finance lease is a type of lease that is used to finance the acquisition of an asset. It is a lease in which the lessee assumes substantially all the risks and rewards of ownership of the leased asset. In a finance lease, the lessee is responsible for the maintenance, insurance, and other costs related to the leased asset. At the end of the lease term, the lessee has the option to purchase the leased asset at a price that is significantly lower than the fair market value of the asset.

Credit: www.chegg.com

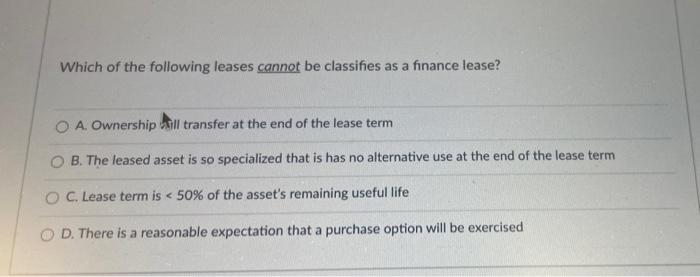

Which of the Following Leases Would Not Be Classified As a Finance Lease?

1. A lease with a bargain purchase option

A bargain purchase option is an option that allows the lessee to purchase the leased asset at a price that is significantly lower than the fair market value of the asset. If a lease includes a bargain purchase option, the lease would be classified as a finance lease. Therefore, a lease with a bargain purchase option would not be classified as an operating lease.

2. A lease with a lease term equal to 75% or more of the estimated economic life of the leased asset

If a lease term is equal to 75% or more of the estimated economic life of the leased asset, the lease would be classified as a finance lease. Therefore, a lease with a lease term equal to 75% or more of the estimated economic life of the leased asset would not be classified as an operating lease.

3. A lease where the present value of the lease payments is equal to or greater than 90% of the fair market value of the leased asset

If the present value of the lease payments is equal to or greater than 90% of the fair market value of the leased asset, the lease would be classified as a finance lease. Therefore, a lease where the present value of the lease payments is equal to or greater than 90% of the fair market value of the leased asset would not be classified as an operating lease.

4. A lease where the leased asset is of a specialized nature such that only the lessee can use it without major modifications

If the leased asset is of a specialized nature such that only the lessee can use it without major modifications, the lease would be classified as a finance lease. Therefore, a lease where the leased asset is of a specialized nature such that only the lessee can use it without major modifications would not be classified as an operating lease.

:max_bytes(150000):strip_icc()/operating-lease-4191822-1-c4b12434faf241c1ba94b5709525034a.jpg)

Credit: www.investopedia.com

Frequently Asked Questions

What Factors Determine A Finance Lease?

Finance leases are determined by transfer of risks and rewards, ownership transfer, and lease term.

How Is A Finance Lease Different From Operating Lease?

Finance leases show asset ownership transfer, while operating leases don’t transfer ownership.

Can A Lessee Purchase The Asset In A Finance Lease?

Yes, the lessee can often purchase the asset at a bargain price in a finance lease.

What Accounting Treatment Is Applied To Finance Leases?

Finance leases are recognized as assets and liabilities on the lessee’s balance sheet.

Why Is It Important To Classify Leases Correctly?

Correctly classifying leases impacts financial statements, tax implications, and business decisions.

Conclusion

In conclusion, a finance lease is a lease in which the lessee assumes substantially all the risks and rewards of ownership of the leased asset. A lease with a bargain purchase option, a lease with a lease term equal to 75% or more of the estimated economic life of the leased asset, a lease where the present value of the lease payments is equal to or greater than 90% of the fair market value of the leased asset, and a lease where the leased asset is of a specialized nature such that only the lessee can use it without major modifications would not be classified as an operating lease.