The Fifth Foundation of Personal Finance is paying off your mortgage early. This strategy enhances financial freedom and long-term wealth.

Understanding the concept of personal finance is crucial for achieving economic stability and growth. The Fifth Foundation stands as a pivotal element in this understanding, advocating for the early payoff of a mortgage. Embracing this principle helps individuals reduce interest costs, accelerate equity buildup, and increase net worth over time.

By focusing on this goal, homeowners can unlock the door to financial independence, allowing them to allocate resources to retirement, investments, and other wealth-building activities. Prioritizing mortgage repayment is not only economically astute but also imbues a sense of security and accomplishment. This foundation can be a game-changer in personal finance management, signaling a milestone in the journey towards a sound financial future.

The Five Pillars Of Personal Finance

Understanding personal finance is key to building a solid future. It rests on five pillars. These are the foundations for financial success. Let’s explore the vital elements for a secure financial life!

Key Components Of Financial Stability

Financial stability doesn’t happen overnight. It requires strategy and discipline. You must know the key components:

- Budgeting: Track and plan your spending.

- Saving: Put money aside for future needs.

- Investing: Grow your wealth over time.

- Protection: Insure against life’s uncertainties.

- Debt Management: Keep your borrowing under control.

Balance in these areas leads to solid ground under your feet. Get these right, and you’re on your way.

A Quick Glance At The First Four Foundations

| Foundation | Purpose | Tools |

|---|---|---|

| Budgeting | Keep spending in check. | Spreadsheets, apps |

| Saving | Prepare for the unexpected. | High-yield accounts |

| Investing | Build long-term wealth. | Stocks, bonds, real estate |

| Protection | Guard against risks. | Insurance policies |

Each foundation supports the next. Like building blocks, they create a structure for your money. Pay attention to the first four, and the fifth comes easier.

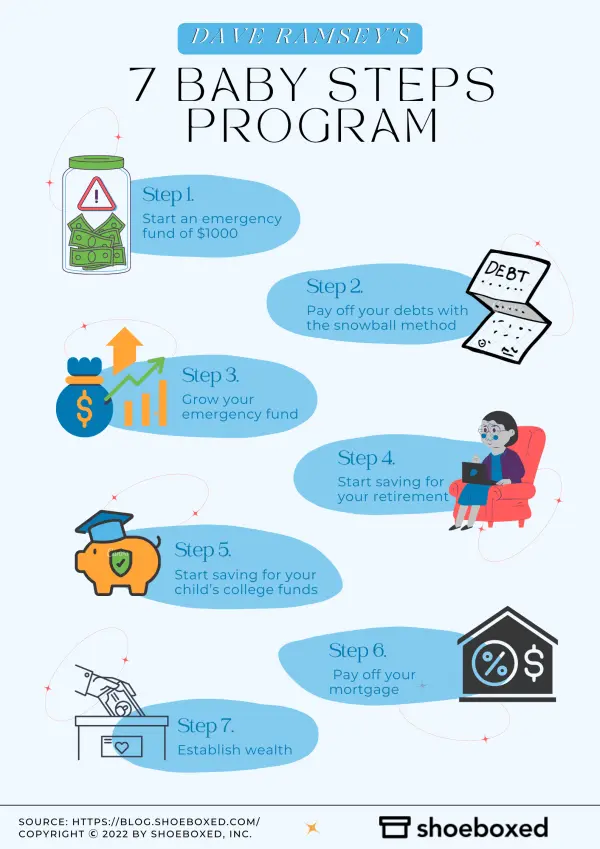

Credit: www.shoeboxed.com

Unveiling The Fifth Foundation

The journey through personal finance often involves a set of principles or foundations. These serve as pillars supporting a sound financial strategy. After delving into basic financial literacy, emergency funds, debt management, and investment strategies, we arrive at a pivotal point: the Fifth Foundation of Personal Finance. This principle can make or break your financial stability and growth.

Why It Matters

The Fifth Foundation is essential for securing long-term financial success. Understanding its role helps individuals maximize their financial potential:

- Empowers informed decisions

- Enhances financial security

- Drives sustained wealth building

This foundation acts as the keystone in a well-architected financial plan and completes your fiscal blueprint.

How It Integrates With Other Foundations

The unique value of the Fifth Foundation lies in its synergy with earlier principles. It doesn’t stand alone but connects each aspect of personal finance:

| Previous Foundations | Integration with the Fifth |

|---|---|

| Financial Literacy | Bolsters the Fifth by providing necessary knowledge |

| Emergency Funds | Acts as a safety net supporting the Fifth |

| Debt Management | Frees up resources for the Fifth’s strategies |

| Investment Strategies | Aligns with the Fifth for growth and returns |

Implementing the Fifth Foundation effectively ensures that your financial plan moves forward cohesively. It interlocks financial habits with future goals, resulting in a cohesive and solid financial structure.

Maximizing Your Wealth With The Fifth Foundation

Building wealth requires more than just saving money. The fifth foundation of personal finance is all about expanding your financial potential. It involves strategies that amplify your assets and grow your income over time. Maximizing wealth takes a savvy approach to financial planning, smart investments, and continuous learning. Let’s deep dive into the strategies and common pitfalls to avoid for making the most of your financial foundation.

Strategies For Growth

Embarking on a wealth maximization journey involves a mix of tactics tailored to boost your financial health. Consider the following strategies to propel your personal finance to new heights:

- Invest Wisely: Diversify your portfolio to balance risk and return.

- Seek Education: Continuously learn about new financial tools and products.

- Retirement Accounts: Maximize contributions to retirement plans for long-term growth.

- Income Sources: Explore multiple streams of income to reinforce financial stability.

- Automation: Automate savings and investments to ensure steady growth.

A strategic approach involves setting clear financial goals and taking decisive actions to meet them. Regularly review and adjust your plan to stay on track.

Avoiding Common Pitfalls

While working towards wealth maximization, it is crucial to sidestep mistakes that can hinder progress. Awareness and action keep your financial journey on course.

- Lack of Planning: Without a solid plan, it’s easy to stray off course. Set specific goals and establish a roadmap for achieving them.

- Ignoring Debt: High-interest debt can counteract your wealth-building efforts. Prioritize paying down debt to free up more resources for growth.

- Investment Blindspots: Knowledge gaps can lead to poor investment decisions. Educate yourself to make informed choices.

- Overspending: Living within your means allows you to allocate more funds toward growth opportunities.

- Skipping Emergency Funds: Secure a financial safety net to avoid dipping into investments during unexpected events.

By embracing growth strategies and sidestepping common financial missteps, you unlock the full potential of the fifth foundation. Boosting personal wealth thus becomes an achievable, systematic process rather than a mere dream.

Credit: www.businesswire.com

Real-world Applications

The Fifth Foundation of Personal Finance, often emphasizing ongoing education and personal growth, gains tangible shapes in our everyday lives. Illustrating this, we see individuals applying financial tenets to reach remarkable goals.

Case Studies

Examining real case studies reveals practical insights into the Fifth Foundation’s impact on finances.

- Family Budget Rebalance – The Smiths, by adjusting expenses, saved for a down payment on a home.

- Debt Elimination Journey – John reduced his debt by creating a meticulous payment plan.

- Retirement Planning – At 30, Emily started investing in a retirement fund, showcasing compound interest benefits.

Success Stories

Success stories inspire others to pursue financial wisdom and secure their future.

- Liam’s Investment Triumph – By studying market trends, Liam turned a modest sum into a considerable portfolio.

- Emma’s Educational Impact – Investing in her skills, Emma increased her income threefold in five years.

- Noah’s Frugal Living – By living below his means, Noah saved enough to travel the world.

Challenges To The Fifth Foundation

Mastering the art of personal finance ensures a stable future. The Fifth Foundation of Personal Finance includes strategies for growing and protecting your wealth. Yet, many face roadblocks when applying these principles. Let’s explore the hurdles and how to overcome them.

Recognizing Risk Factors

Risk is part of financial growth. Knowing what affects your money matters. Identify risk factors that may threaten your financial well-being.

- Job Security: Employment changes impact income.

- Market Volatility: Investments can fluctuate wildly.

- Unexpected Expenses: Emergency costs arise without warning.

- Health Issues: Medical bills can escalate quickly.

- Life Changes: Family dynamics, such as divorce, shift financial priorities.

Mitigative Measures For Financial Health

After risks are known, plan to protect your finances. Sound planning will guard against common pitfalls.

- Emergency Fund: Save at least three to six months of expenses for a cushion.

- Insurance: Get coverage for health, property, and life, to offset losses from unforeseen events.

- Diversified Investments: Spread your investments to reduce the risk of significant losses.

- Regular Health Checks: Maintain your health to avoid hefty medical expenses.

- Legal Planning: Have a will and other legal documents sorted to handle life changes smoothly.

By taking these steps, strengthen your financial foundation against risks. A proactive approach to managing wealth ensures you’re ready for what lies ahead.

Credit: www.ebay.com

Planning For The Future

Personal finance is a journey with a clear direction—securing your future. The fifth foundation, planning for the future, sets the stage for a life of financial comfort. It involves careful thought, strategic actions, and a vision that stretches well into the years ahead. By adhering to this foundation, you build a roadmap to your financial dreams and goals.

Setting Long-term Goals

Setting goals shapes your financial blueprint. It involves identifying what you want to achieve and outlining steps to get there. These goals might include buying a home, saving for retirement, or funding education. Shaping these aspirations requires a mix of:

- Realism: Goals should be achievable.

- Timeframes: Assign deadlines to your goals.

- Priority: Focus on what matters most to you.

Use a table to organize and prioritize these goals:

| Goal | Timeframe | Priority |

|---|---|---|

| Home Purchase | 5 years | High |

| Retirement Savings | 30 years | Medium |

| Education Fund | 10 years | Low |

Adapting The Fifth Foundation Over Time

Time brings change, and so must your approach to the future. Adapting your financial plan is crucial. As life unfolds, your goals and resources will evolve. Here’s how to stay on track:

- Review your finances annually.

- Adjust your goals as life changes.

- Stay informed about financial trends.

- Rebalance your portfolio to manage risk.

Remember, a flexible plan is a strong plan. It ensures you stay aligned with your changing needs and the ever-evolving financial landscape.

Frequently Asked Questions On What Is The Fifth Foundation Of Personal Finance

What Are The 5 Basics Of Personal Finance?

The five basics of personal finance include budgeting, saving, investing, managing debt, and understanding taxes.

What Are The 5 Areas Of Personal Finance?

The five areas of personal finance include income management, saving, investing, spending, and protecting wealth. Each aspect plays a crucial role in achieving financial stability and growth.

What Does The Five Foundation Do?

The Five Foundation supports global access to water, sanitation, hygiene, nutrition, and menstrual health equity.

What Are The 5 Importance Of Personal Financial Planning?

Personal financial planning helps manage expenses, reduce debts, increase savings, achieve life goals, and ensure financial security.

What Is Personal Finance Fifth Foundation?

The Fifth Foundation of Personal Finance is achieving financial independence through savings, investments, and wealth-building strategies.

Conclusion

Understanding the fifth foundation of personal finance prepares you for a stable financial future. It anchors your money habits in solid ground. Embrace this knowledge; witness your savings grow and stress diminish. Let this cornerstone guide your path to financial wisdom and security.

Start now—the results await.