G&A in finance refers to “General and Administrative” expenses. These costs are associated with the day-to-day operations of a business.

General and Administrative (G&A) expenses are the overhead costs incurred by a company that are not directly tied to a specific product or service. These costs typically include salaries of executive management, costs related to administrative employees, office supplies, legal and accounting services, utilities, and rent for office space.

G&A is a crucial aspect of a company’s overall financial health as it affects net income and operational efficiency. Careful management of G&A expenses can lead to improved profit margins and successful business operations. Being aware of these costs helps investors and managers make informed decisions regarding the company’s cost management and operational strategies.

Credit: www.universalcpareview.com

Decoding G&a Finance

G&A Finance stands for General and Administrative Finance. It covers all the expenses a business incurs to manage its day-to-day operations. Unraveling G&A Finance can empower companies to streamline their budget and enhance cost-efficiency. Let’s dive into the core elements before distinguishing G&A from direct costs.

The Core Elements

Understanding G&A requires focusing on its key components:

- Rent: Costs for office space.

- Utilities: Water, electricity, and other services.

- Salaries: Wages for administrative staff.

- Insurance: Protection against various risks.

These are just snapshots of what goes into G&A finance.

G&a Vs. Direct Costs

| G&A Finance | Direct Costs |

|---|---|

| Incurred regardless of production levels. | Directly tied to the production of goods or services. |

| Not directly attributable to a specific product. | Can be allocated to specific products or projects. |

| Examples include office supplies and certain salaries. | Examples include raw materials and manufacturing labor. |

Distinguishing between these costs helps to optimize spending and improve financial strategies.

The Role Of G&a In Business

General and Administrative (G&A) finance is a key player in any company. It handles day-to-day operations and sets a solid base for the business. Think of G&A as the brain of a company. It makes sure everything else works smoothly.

Budgeting For Growth

Budgeting is like planning a big trip. You need to know how much you can spend. It decides how a business will use its money. Good budgeting makes room for new hires, marketing plans, and more. Here’s how G&A helps in budgeting:

- Tracks Spending: G&A watches where every penny goes.

- Plans Ahead: It creates a roadmap for spending in the future.

- Helps Save: It finds ways to cut costs without harming growth.

Strategic Planning And Analysis

Strategic planning is like building a Lego set. You need the right pieces and a good plan. G&A looks at what the company does well and finds areas to improve. Here are ways G&A shapes strategy:

| Strategy Type | How G&A Contributes |

|---|---|

| Long-Term Goals | Sets targets for where the business wants to be in the future. |

| Risk Management | Finds risks so the company can avoid or fix them. |

| Market Analysis | Studies the market to help the business understand its position. |

Calculating G&a Expenses

Calculating General & Administrative (G&A) expenses is crucial for businesses aiming to manage costs effectively. These expenses support the overall operations, defining a substantial part of any organization’s financial health. Understanding and accurately calculating this overhead will help in creating a more efficient budget.

Typical Components

G&A expenses often include various non-production costs. Companies frequently review these items:

- Rent or mortgage payments for office spaces

- Utilities like electricity, water, and internet

- Salaries of executive, administrative, and support staff

- Office supplies and equipment

- Legal and professional fees for services outside of production needs

- Insurance that doesn’t directly relate to the production of goods or services

- Depreciation of capital assets

- Taxes not directly tied to production

Allocation Methods

Allocating G&A expenses to different departments can be challenging. Two common methods to distribute costs are:

- Direct Allocation: Costs directly tied to a specific department get allocated fully to it.

- Indirect Allocation: Overheads are distributed based on usage or other equitable formulas.

Businesses can use various formulas for indirect allocation, such as:

| Method | Description | Example of Usage |

|---|---|---|

| Square Footage | Expenses are allocated based on the space a department occupies. | Rent or Utilities |

| Percentage of Sales | Allocation done in proportion to a department’s revenue contribution. | Marketing Expenses |

| Headcount | Distributed based on the number of employees in each department. | HR and Admin Salaries |

To ensure fairness and accuracy, companies may apply a mix of these methods based on the nature of the expense and company structure.

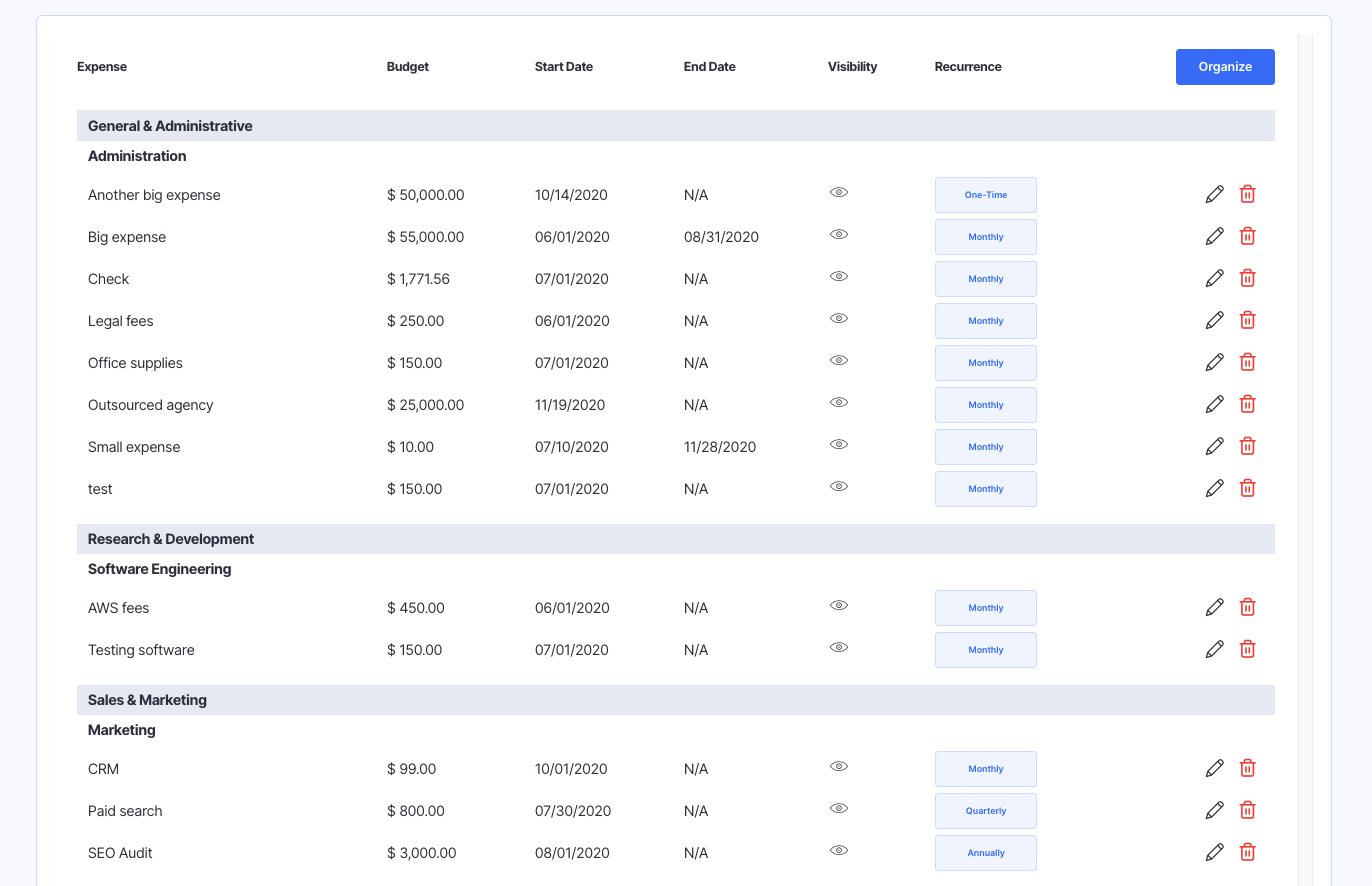

Credit: finmark.com

Managing G&a Effectively

Managing General & Administrative (G&A) Finance demands strategic planning and attention to detail. It involves optimizing back-office operations and expenditures to support the greater goals of a business. In doing so, companies ensure that they not only survive but thrive in competitive markets.

Cost Control Strategies

Effective G&A cost management begins with implementing robust strategies. These strategies keep expenses in check while optimizing operational efficiency. Let’s delve into cost-control measures every business should consider:

- Zero-based budgeting – Start each budget from zero. Justify every expense, every year.

- Benchmarking – Compare costs with similar companies. Identify areas for improvement.

- Outsourcing – Delegate non-core activities. Focus on your strengths.

- Vendor management – Negotiate better terms. Monitor vendor performance.

Technology And G&a Efficiency

Technology drives G&A efficiency through automation and improved processes. Tech solutions enable businesses to:

| Technology Solutions | Benefits |

|---|---|

| Cloud Computing | Access data anywhere. Scale resources as needed. |

| Business Intelligence Tools | Gain insights. Make informed decisions. |

| Financial Software | Streamline accounting. Improve accuracy. |

| Automation Platforms | Reduce manual tasks. Increase productivity. |

G&a In Financial Reporting

G&A in Financial Reporting refers to the General and Administrative expenses that companies report on their financial statements. These are the costs related to managing a business. They differ from selling or production costs. G&A expenses are necessary for a company to function. They appear on the income statement. This affects the overall profitability of a company. Let’s dive into how this works through accounting practices and their impact on profitability.

Accounting Practices

Proper accounting practices ensure G&A expenses are recorded accurately. These expenses include salaries of executives, office supplies, and rent. They cover utility bills and legal costs too. G&A expenses get categorized as indirect costs. This means they do not tie directly to the creation of products or services. Accountants record these costs periodically. This is usually done every fiscal quarter or year.

- Compliance with accounting standards is key.

- Transparency in reporting builds investor trust.

- Consistency makes comparing financial statements easier.

Impact On Profitability

G&A expenses directly affect a company’s bottom line. They are subtracted from the total revenue. This gives the net income for the period. High G&A costs can lower profits. Companies analyze these expenses closely. They look for ways to cut back without harming operations. This can increase profitability.

| Total Revenue | G&A Expenses | Net Income |

|---|---|---|

| Money earned from sales | Costs of running the business | What’s left after costs |

Focus on efficient spending is vital. It helps keep G&A expenses in check. A slight reduction can lead to a significant increase in net income. It boosts the overall financial health of a company.

Credit: www.patriotsoftware.com

Future Of G&a Finance

The financial landscape is constantly evolving, and G&A (General and Administrative) Finance is no exception. Advances in technology and shifts in corporate strategies are paving the way for a modernized approach. In the dynamic world of G&A Finance, adapting to change is critical for success. Let’s delve into trends set to shape the future.

Emerging Trends

Staying ahead of the curve involves recognizing and embracing new developments. Here are key emerging trends:

- Decentralization: Power shifts away from central finance teams to empower individual departments.

- Real-time analytics: Instant data assessments influence swift strategic decisions.

- Sustainability: Eco-friendly practices become intrinsic to financial operations.

- Globalization: Cross-border financial management grows in complexity and importance.

Automation And Ai Integration

Automation and Artificial Intelligence (AI) are revolutionizing G&A Finance. They bring efficiency and precision to previously manual processes. Here’s what this integration looks like:

| Area of Impact | Automation and AI Benefits |

|---|---|

| Budgeting | Faster, error-free forecasting |

| Reporting | Automated, insightful reports |

| Expense Management | Streamlined approvals and tracking |

| Risk Management | Proactive risk identification |

A future where G&A Finance is deeply integrated with Automation and AI is not just a prediction—it’s already unfolding. As companies adapt, they reap the benefits of increased productivity and sharper strategic insights. The transformation of G&A Finance continues, and those prepared for these advancements will lead the charge into a new era of financial excellence.

Frequently Asked Questions For What Is G&a Finance

What Are The Examples Of G&a Expenses?

Examples of G&A expenses include office rent, utilities, insurance, management salaries, and legal fees. They typically cover overhead not directly tied to product creation or service delivery.

What Does G&a Stand For In Finance?

G&A in finance stands for General and Administrative expenses. These are overhead costs not directly tied to a specific product or service.

What Is G&a Vs Sg&a?

G&A refers to General and Administrative expenses, crucial for day-to-day operations. SG&A combines G&A with Sales and Marketing costs, covering overall operational expenses.

What Salaries Are Included In G&a?

G&A salaries include executive compensations, administrative staff wages, and support personnel salaries. These reflect management and office-related expenses.

What Does G&a In Finance Stand For?

General and Administrative (G&A) expenses refer to the day-to-day operational costs not directly linked to producing goods or services.

Conclusion

Understanding G&A finance is crucial for business success. It ensures that overhead costs are managed efficiently. This knowledge helps in strategic decision-making and financial planning. Remember, effective G&A financial management can be the difference between thriving and barely surviving. Stay informed and take the necessary steps to optimize your general and administrative expenses.