If you’re in the market for a motorcycle, you may be considering purchasing from a private seller. While this can be a great way to find a good deal, it can also present some unique challenges when it comes to financing. Unlike buying from a dealership, private sellers won’t offer in-house financing options. But don’t worry, there are still several ways you can finance a motorcycle from a private seller. In this article, we’ll go over some of your options and what you need to know before making a purchase.

Credit: www.harley-davidson.com

Option 1: Personal Loan

One option for financing a motorcycle from a private seller is to take out a personal loan from a bank or credit union. This can be a good option if you have good credit and can secure a favorable interest rate. Personal loans typically have fixed interest rates and a set repayment schedule, which can make budgeting and planning easier.

Before applying for a personal loan, it’s important to determine how much you can afford to borrow and what your monthly payments will be. You should also shop around and compare rates from different lenders to make sure you’re getting the best deal.

Option 2: Credit Card

Another option for financing a motorcycle from a private seller is to use a credit card. This can be a good option if you have a credit card with a high enough limit and a low interest rate. However, it’s important to be aware that using a credit card to finance a motorcycle can be risky. Credit card interest rates can be high, and if you’re not able to pay off the balance in full each month, you could end up paying a lot in interest charges.

If you do decide to use a credit card to finance a motorcycle, make sure you understand the terms and conditions of your card and have a plan in place to pay off the balance as quickly as possible.

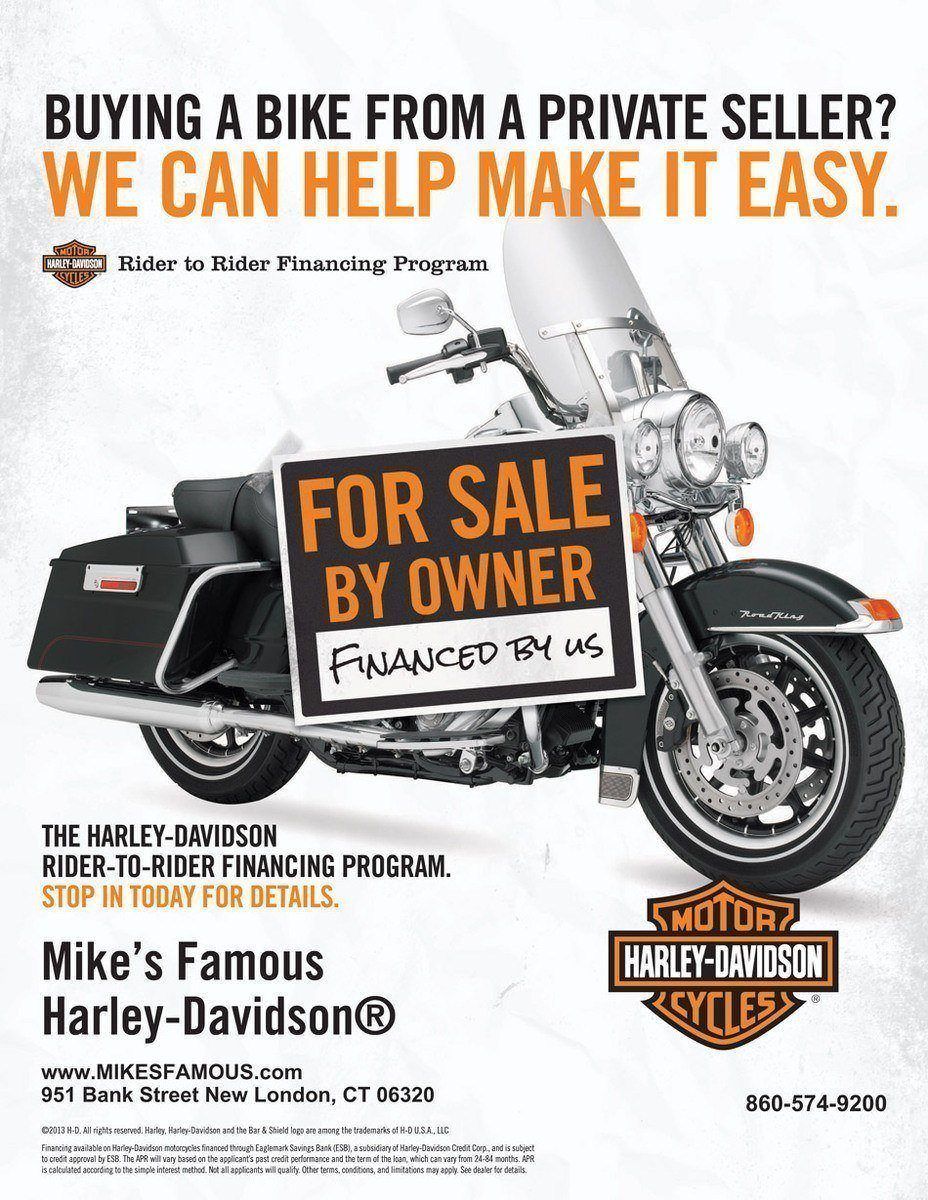

Credit: www.mikesfamous.com

Option 3: Peer-to-Peer Lending

Peer-to-peer lending is another option for financing a motorcycle from a private seller. This involves borrowing money from individuals rather than a traditional financial institution. Peer-to-peer lending platforms connect borrowers with investors who are willing to lend money at a certain interest rate.

Peer-to-peer lending can be a good option if you have a less-than-perfect credit score or if you’re having trouble securing a loan from a traditional lender. However, interest rates can be high, and you’ll need to make sure you’re working with a reputable platform.

Things to Consider Before Financing a Motorcycle from a Private Seller

Before financing a motorcycle from a private seller, there are a few things you should keep in mind:

- Get the motorcycle inspected: Before making a purchase, it’s important to have the motorcycle inspected by a mechanic to make sure it’s in good condition.

- Check the title: Make sure the seller has a clear title to the motorcycle and that there are no liens or other issues.

- Calculate the total cost: In addition to the purchase price, you’ll need to factor in other costs such as taxes, registration, and insurance.

- Consider a down payment: Putting down a larger down payment can help you secure a lower interest rate and reduce your monthly payments.

- Have a repayment plan: Make sure you have a plan in place to make your monthly payments on time and in full.

Frequently Asked Questions

Can You Finance A Motorcycle From A Private Seller?

Yes, you can finance a motorcycle from a private seller through personal loans or financing companies.

What Documents Are Needed To Finance A Motorcycle?

Typically, you’ll need identification, proof of income, and insurance to finance a motorcycle.

How Can I Negotiate The Price With A Private Seller?

Negotiate by researching the market value and being prepared to walk away if needed.

Are There Any Risks In Financing From A Private Seller?

Risks include potential fraud, lack of warranty, and issues with the bike’s condition.

Can I Get A Loan For A Motorcycle Without A Credit Check?

Some lenders may offer no credit check loans, but they often come with higher interest rates.

Conclusion

Financing a motorcycle from a private seller may require a bit more legwork than purchasing from a dealership, but it can be a great way to find a good deal. Whether you opt for a personal loan, credit card, or peer-to-peer lending, make sure you do your research and have a plan in place before making a purchase.