Financing a car can typically take from a few hours to a week. The exact time depends on factors like credit approval and documentation.

Financing a car is a step most buyers go through, and the time it takes can vary. Quick pre-approval processes mean you could walk into a dealership and drive out with a financed car within a few hours if everything lines up.

But, should any issues arise, such as a need for additional documentation or problems with credit approval, the process can extend to several days or even a week. Understanding this timeline is crucial for potential car buyers planning around their need for a vehicle. With the right preparation and a clear understanding of your credit situation, you can streamline the financing process. Remember, an efficient and straightforward approach to car financing starts with being well-prepared and working with reputable lenders.

The Basics Of Car Financing

Welcome to our guide on the essentials of car financing. This process might seem daunting at first, but understanding the basics can make securing your new ride a smoother journey. Let’s steer through the primary steps involved and what you can expect when financing a vehicle.

Key Factors Influencing Financing Time

Several elements play crucial roles in how long it takes to finance a car. Notably:

- Credit Score: A higher score can mean faster approval.

- Loan Type: Various options can affect processing times.

- Documentation: Having papers ready speeds up the process.

- Lender’s Speed: Some lenders simply work quicker than others.

- Vehicle Type: New cars usually process faster than used ones.

Typical Timeline From Application To Approval

The journey from application to approval often follows a set path:

- Application Submission: Filling out forms with necessary details.

- Document Verification: Lender checks the paperwork you provide.

- Credit Check: A review of your credit history is conducted.

- Approval: Lender agrees to the loan under certain terms.

- Finalization: Signing the agreement completes the process.

A typical timeline can range from a few hours to a week.

Note: This timeframe can vary greatly based on the factors mentioned previously.

Credit: www.forbes.com

Preparation Before Applying

Knowing the steps before applying helps smooth the car financing process. It could mean quicker approval and better loan terms. Start with getting your documents in order and checking your credit score.

Gathering Necessary Documents

Before reaching out to lenders, collect the essential paperwork. Here’s a checklist:

- Identification: A valid driver’s license or passport.

- Proof of Income: Recent pay stubs or tax returns.

- Employment Verification: Employer contact details may be required.

- Proof of Residence: Utility bills or a lease agreement work well.

- Vehicle Information: Details of the car you intend to buy.

- Insurance Documents: Proof of auto insurance or a quote.

Having these documents ready speeds up the financing process.

Improving Credit Score For Better Rates

A higher credit score can unlock lower interest rates. Consider these tips:

- Check your credit report for errors.

- Pay off existing debt if possible.

- Keep credit card balances low.

- Avoid new credit applications before car financing.

Improving your score takes time but significantly affects your loan terms.

Choosing The Right Financing Option

Getting your dream car is exciting. Choosing the right financing is key to a smooth purchase. Explore options to find what fits your budget and lifestyle.

Dealership Financing Versus Bank Loans

Your choice impacts your wallet and car-buying experience. Let’s break down the differences:

- Dealership Financing: Convenient, sometimes with special offers for buyers.

- Bank Loans: Might offer better rates, requires shopping around.

Remember, deals can vary so compare carefully. Ask about promotions and weigh the terms.

Understanding Loan Terms And Conditions

Knowing your loan agreement is crucial. Dodge surprises by understanding every detail.

| Term | Meaning |

|---|---|

| APR | Annual Percentage Rate, or the cost of borrowing. |

| Loan Term | How long you make payments. |

| Monthly Payment | Amount paid each month. |

Check for prepayment penalties or additional fees. Ask questions. Know exactly what you sign up for.

:max_bytes(150000):strip_icc()/what-happens-when-you-buy-too-much-car.aspx-final-2d09842fa68a4ddba2baa0c5065fa4ab.png)

Credit: www.investopedia.com

Application Process

The Application Process for financing a car is the stepping stone to getting your dream vehicle. Knowing the procedure eases worries and speeds things up. This detailed journey begins with your application and ends once you receive the green light from the lender.

Steps To Apply For A Car Loan

To start your car financing journey, follow these essential steps:

- Gather Documents: Have your ID, proof of income, and residence ready.

- Credit Score Check: Know your score as it affects your loan terms.

- Research Lenders: Look at banks, credit unions, and online lenders.

- Compare Rates: Find the best interest rates for your financial situation.

- Complete Application: Fill out the lender’s form with accurate details.

- Submit Application: Once done, send it to the lender for consideration.

Waiting Period For Loan Approval

After applying, a common question is, “How long until I know if I’m approved?”

The waiting period can vary based on:

- Lender processing time.

- Accuracy of your application information.

- Complexity of your financial situation.

Typically, the feedback loop ranges from a few hours to a couple of days.

Quick Tip: Some lenders offer instant approval for well-qualified applicants, but make sure you read the fine print.

Factors That May Delay Financing

Getting ready to finance a car stirs up excitement! Yet, the road to approval sometimes has delays. Let’s explore common speed bumps on this journey.

Several elements can stretch the timeline for your car financing. Understanding these can save you from frustration.

Credit Issues And Verification

- Your credit score can make or break the deal. A strong score means swift approval. A lower score triggers more checks.

- Lenders scrutinize your history. They look for red flags like missed payments or large debts.

- Verifying income and employment takes time. A steady job and regular income are musts for lender’s green light.

Negotiation Hurdles With Dealers

- Finding common ground on price can lead to back-and-forth talks with dealers.

- Trade-ins add complexity. Agreeing on a fair value can slow things down.

- Extras and add-ons like warranties or service plans can prolong discussions.

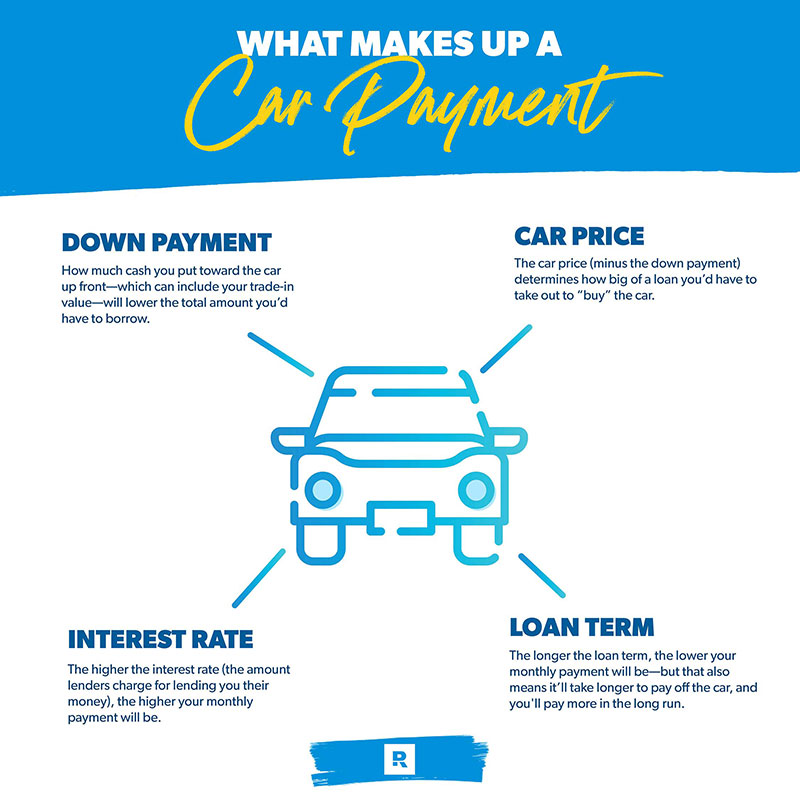

Credit: www.ramseysolutions.com

Finalizing The Purchase

Getting to the finale of your car financing journey is an exciting moment. It’s where you move from agreement to ownership. This stage, often the quickest, transforms the dream into reality. Knowing what to expect will help you get through it with ease and confidence. Let’s examine the steps.

Signing The Paperwork

Signing the paperwork is a key step in buying your car. It involves a few important documents. Be sure to read each one carefully. Ask questions if something isn’t clear. You’ll sign the finance contract, which includes the loan amount, interest rate, and payment schedule. Also, you’ll handle the vehicle’s title and registration forms. Keeping copies of all documents is a smart move.

- Finance Agreement: This outlines your loan details.

- Bill of Sale: It confirms the sale of the vehicle.

- Extended Warranties: Decide if these are right for you.

- Insurance Documents: Proof of insurance is a must.

Taking Delivery Of Your New Car

After all papers are signed, you take delivery of your new car. The dealer will walk you through the car’s features. They will help set up systems like Bluetooth and GPS. Inspecting the car before driving off is vital. Check for any damage or issues. Ensure you are comfortable with all the controls. Once satisfied, you can drive away in your new vehicle!

- Inspect the car thoroughly for any defects.

- Ensure all features work as they should.

- Review the owner’s manual for maintenance tips.

- Adjust your seat, mirrors, and controls for comfort.

Frequently Asked Questions Of How Long Does It Take To Finance A Car

How Long Should You Finance Your First Car?

Finance your first car for the shortest term affordable, typically around 60 months. Shorter loan periods mean higher payments but lower interest charges. Choose a term that aligns with your budget and financial goals.

What Is A Normal Amount Of Time To Finance A Car?

A typical car loan term ranges from 36 to 72 months. Most people opt for 60-month financing.

How Much Is A 30 000 Car Loan?

The monthly payment on a $30,000 car loan varies based on the interest rate and loan term. For example, over a 60-month period at a 4. 5% interest rate, estimated payments are around $559 per month.

What Is The Lowest Credit Score To Buy A Car?

The lowest credit score typically required to buy a car is around 500, but options may be limited and interest rates higher.

What Factors Affect Car Finance Timing?

Car finance timing can be influenced by credit score, loan approval processes, dealership documentation, and the borrower’s responsiveness.

Conclusion

Understanding car financing timelines is crucial for any prospective buyer. An average span ranges from a few days to a couple of weeks. Variables like credit score, loan approval, and dealership protocols play pivotal roles. Remember, a well-researched approach can expedite the process.

Start your journey with confidence, knowing preparation paves the way to a smoother car financing experience.