American First Finance offers a lease-to-own payment solution for consumers to purchase goods. It provides flexible payment plans compatible with bad or no credit history.

Understanding the mechanics of how you can get your hands on your desired products without the burden of a hefty upfront payment is key to managing your finances effectively. American First Finance steps in as a facilitator between you and your goals, whether they involve updating your home furnishing, upgrading technology, or ensuring your garage has the latest tools.

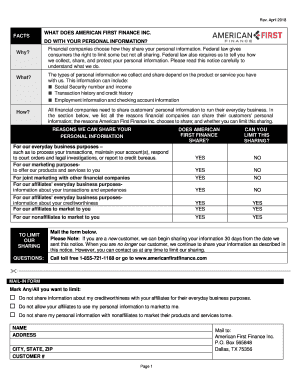

With a quick and straightforward application process that can be completed either online or in-store, the company approves customers for a certain amount based on eligibility criteria. This enables consumers to shop at various retail partners and potentially take the items home the same day, with payment plans structured over time to ease the financial load.

Credit: www.linkedin.com

Introduction To American First Finance

Imagine buying what you need, when you need it, without the upfront cash. American First Finance makes this possible. It offers flexible payment options. This way, more people can buy what they want. Let’s explore how this company changes the game.

Making Credit Accessible

American First Finance opens doors to easy credit. This is good news for those with less-than-perfect credit scores. The company provides a solution to buy today and pay later.

- Quick Application Process

- Approvals Not Solely Based on Credit Score

- Flexible Payment Plans

These features make it easier for customers to get what they need. They do not have to wait until they save up enough money.

A Brief History Of American First Finance

Founded to help customers manage purchases, American First Finance started in 2013. Since then, it has helped countless shoppers. It stands out in finance services.

| Year | Milestone |

|---|---|

| 2013 | Company Launch |

| 2015 | Nationwide Expansion |

| 2020 | Online Application Rollout |

This timeline shows the growth of American First Finance. Each milestone brought new opportunities for customers.

Eligibility Criteria For Customers

Understanding the eligibility criteria for American First Finance is crucial for hopeful applicants. Specific requirements must be met to access financing options. Here’s a detailed look at what customers need to know.

Credit Requirements

American First Finance provides options for a wide range of credit profiles. No minimum credit score is needed to apply. Applicants with various credit histories are welcome.

- Both good and bad credit applicants may apply

- Financing decisions are based on multiple factors

- Previous credit information could influence approval

Income Verification Process

Income verification is part of the application process. Applicants must prove steady income to qualify. Here are the steps and documents involved:

- Provide recent pay stubs or bank statements

- Show a history of consistent income

- Self-employed individuals may need additional documents

| Type of Employment | Document Required |

|---|---|

| Employed | Pay stubs, W-2 forms, or employer letters |

| Self-Employed | Bank statements, tax returns, or 1099 forms |

Secure financing requires solid proof of income. Customers should prepare these documents in advance. This will ensure a smoother application process.

Application Process Explained

Welcome to the simple and straightforward application process for American First Finance. This guide unpacks each step needed to apply with ease. Perfect for those seeking a fast, flexible financing solution.

Steps To Apply

- Visit the American First Finance website or partner retailer.

- Choose the product or service you wish to finance.

- Click on the financing option to start your application.

- Fill out the application form with your personal information.

- Submit the form and wait for a quick approval decision.

- Review and sign your contract if approved.

- Shop with your approved financing amount.

Documentation Needed

To ensure a smooth application process, gather these documents in advance:

- ID proof: A valid, government-issued photo ID.

- Social Security number: For credit check and verification.

- Income details: Recent pay stubs or income statements.

- Bank details: An account to set up payments.

Credit: www.facebook.com

Financing Options Offered

Understanding the range of financing options American First Finance offers is crucial. These options provide a pathway to acquiring what you need without the immediate financial burden. American First Finance ensures a variety of programs to suit different needs.

Retail Installment Contracts

Retail installment contracts let customers pay over time. They’re an agreement where the total cost splits into smaller amounts. Here’s what they bring to the table:

- A fixed payment schedule

- Transparent terms – no hidden fees

- Ownership after final payment

These contracts are simple. You pay a set amount each period until full ownership transfers to you.

Lease-to-own Programs

Lease-to-own programs give a flexible option. You lease the product now and decide later to purchase. Benefits include:

- Lower initial cost

- Option to buy or return at lease end

- Early purchase options available

This choice is great for those needing to spread out expenses over a longer period with added flexibility.

Understanding The Payment Structure

The American First Finance (AFF) system lets people buy things now and pay later. Knowing how payments work is key. Let’s break down the repayment terms and the costs you need to know about.

Repayment Terms

With AFF, you get a plan to pay over time. This makes buying easier. Here’s what you should know about repaying:

- Flexible timeframes: Choose how long you need to pay.

- Set due dates: Know when payments are due each month.

- Early payoff options: Pay early and save on interest.

Interest Rates And Fees

Understanding rates and fees is vital. AFF charges for borrowing money. They add to your total cost. See below for details.

| Charge Type | Details |

|---|---|

| Interest Rate | A percentage of the remaining balance. |

| Late Fees | Costs for missing a payment. |

| Origination Fees | Upfront costs to process your loan. |

Note that rates vary based on your plan. Always check your terms. Look for any hidden fees. Ask questions if you’re unsure.

Credit: www.uslegalforms.com

Customer Experiences And Reviews

Understanding American First Finance means looking closely at real users’ experiences. Customers often share insights that can help others decide if this finance option suits their needs. Through both praised experiences and disputes, learning from previous clients’ feedback is crucial.

Testimonials And Feedback

Positive reviews showcase the satisfaction of many users:

- “Quick approval process,” notes a happy shopper.

- “Flexible payment options” helped another manage their budget better.

- “Friendly customer service,” a frequent comment, suggests a pleasant user journey.

These testimonials reflect the benefits customers feel they receive from American First Finance.

Handling Customer Disputes

The company also tackles challenges head-on. Complaints are part of any service, and American First Finance is no exception.

When issues arise, American First Finance:

- Engages with customers promptly to understand the problem.

- Provides a dedicated support team to resolve disputes.

- Makes sure they offer a solution that aims to satisfy the customer.

Dispute handling is a significant area where they strive to turn negative reviews into positive outcomes.

Frequently Asked Questions For How Does American First Finance Work

What Does American First Finance Do?

American First Finance provides consumer financing solutions, offering lease-to-own options and loans for retail purchases.

Is It Easy To Get Approved With American First Finance?

Approval for American First Finance isn’t guaranteed; it depends on credit assessment and meeting their criteria. It requires a straightforward application process that evaluates financial information and creditworthiness for a decision.

Can You Pay Off American First Finance Early?

Yes, you can pay off your balance early with American First Finance without incurring prepayment penalties. Early repayment may even save on interest.

What Happens If I Don’t Pay American First Finance?

Non-payment to American First Finance may result in late fees, increased interest rates, negative credit reporting, collection activities, and potential legal action. Please maintain timely payments to avoid such consequences.

What Is American First Finance?

American First Finance (AFF) offers a unique payment solution that allows customers to make purchases with flexible financing options, even if they have less-than-perfect credit.

Conclusion

Navigating your financial options can be a breeze with American First Finance. Their service caters to diverse credit backgrounds, ensuring that purchasing power is within reach. By offering straightforward payment plans, AFF empowers consumers to acquire what they need responsibly.

Remember, managing finances effectively paves the way for a healthier economic future.