When you find yourself in a situation where you are unable to pay your American First Finance bills, it’s important to understand the potential consequences that may arise.

1. Late Payment Fees

If you miss your payment deadline, American First Finance may charge you late payment fees, increasing the amount you owe.

2. Negative Impact on Credit Score

Failure to pay your bills can lead to a negative impact on your credit score, making it harder for you to obtain credit in the future.

3. Collection Calls and Letters

American First Finance may start contacting you through collection calls and letters to remind you of your outstanding payments.

4. Legal Action

If you continue to default on your payments, American First Finance may take legal action against you to recover the debt.

5. Repossession of Goods

For certain types of agreements, such as those involving leased goods, failure to pay may result in American First Finance repossessing the items.

Credit: www.facebook.com

6. Additional Fees and Interest

Non-payment can lead to additional fees, interest, and penalties, further increasing the total amount you owe.

7. Impact on Future Loan Eligibility

Defaulting on American First Finance payments can impact your eligibility for future loans or financing from other institutions.

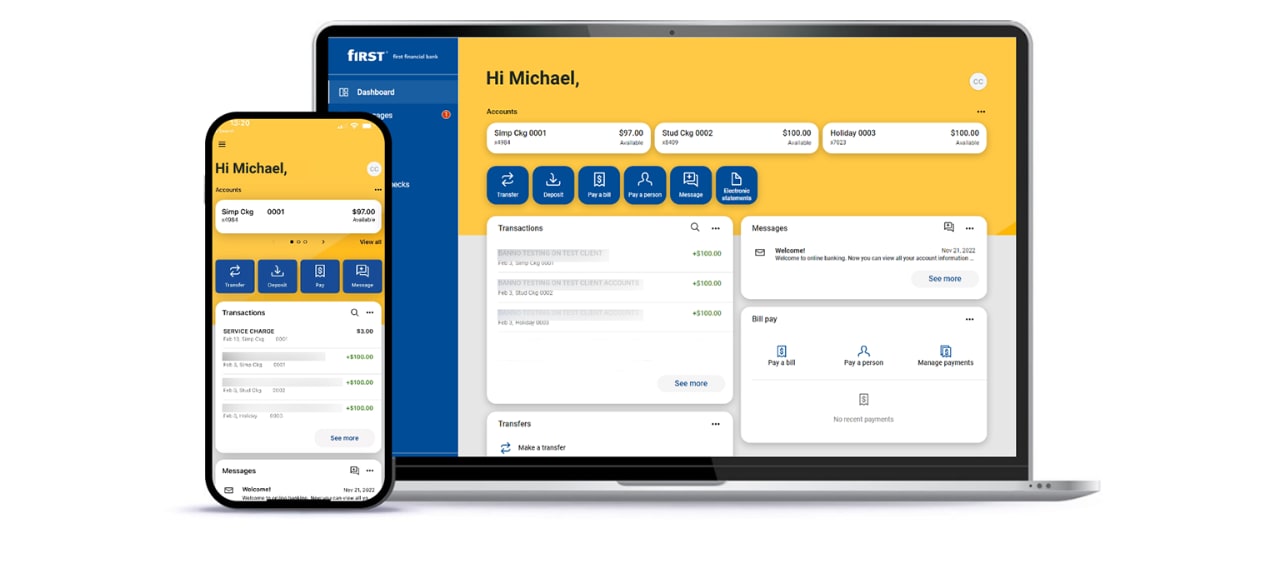

Credit: www.bankatfirst.com

8. Stress and Anxiety

The financial strain of not paying your bills can lead to increased stress and anxiety, affecting your overall well-being.

9. Damage to Reputation

Failing to meet your financial obligations can damage your reputation and credibility with creditors and financial institutions.

10. Difficulty in Resolving the Debt

The longer you delay payment, the harder it may become to negotiate a resolution with American First Finance.

It’s crucial to communicate with the company if you’re facing difficulties in making payments to explore potential solutions and avoid severe consequences.

Frequently Asked Questions

What Are The Consequences Of Not Paying American First Finance?

Failing to pay can result in late fees, damage to credit score, and legal action.

Can American First Finance Take Legal Action For Non-payment?

Yes, they can pursue legal action, including taking you to court.

How Can I Avoid Negative Consequences With American First Finance?

Timely payments, communication, and seeking help if facing financial difficulties.

Will My Credit Score Be Impacted If I Don’t Pay American First Finance?

Yes, non-payment can lead to a negative impact on your credit score.

What Should I Do If I Am Unable To Pay American First Finance?

Contact them immediately to discuss possible payment options or solutions.