Lrp in finance refers to Lease Rental Pooling. It is a strategy utilized by investors to share rental income and expenses from leased equipment.

Lease Rental Pooling (Lrp) serves as a collaborative approach in finance where participants pool their resources, typically involving leased assets like vehicles, machinery, or aircraft, to collectively manage financial risks and returns. This method benefits investors by providing diversified revenue streams, reducing the dependence on individual lease contracts.

Lrp allows asset owners to stabilize income and spread out the cost of asset management, making investment in high-value equipment more accessible and financially sustainable. It also aids in mitigating vacancy risks and ensuring more consistent cash flows for all parties involved. As such, Lrp is a finance tool that contributes to more efficient asset management and investment stability.

Credit: www.onestream.com

Introduction To Lrp In Finance

Long-Range Planning (LRP) is key in steering finances toward future success. It helps businesses plan ahead. It maps out financial goals over time. This planning is vital for long-term success.

The Conception Of Lrp

LRP began as a way to forecast and strategize. Businesses use it to predict future trends and events. This planning makes companies ready for what comes next. They set clear goals. They also prepare for possible financial changes.

Significance In Financial Decision-making

LRP is crucial for smart money choices. It affects how companies invest and spend. Firms that plan well, grow well. With LRP, businesses avoid big risks. They make informed decisions. This keeps them strong in tough times.

- Guides budget creation

- Predicts cash flow needs

- Prepares for market changes

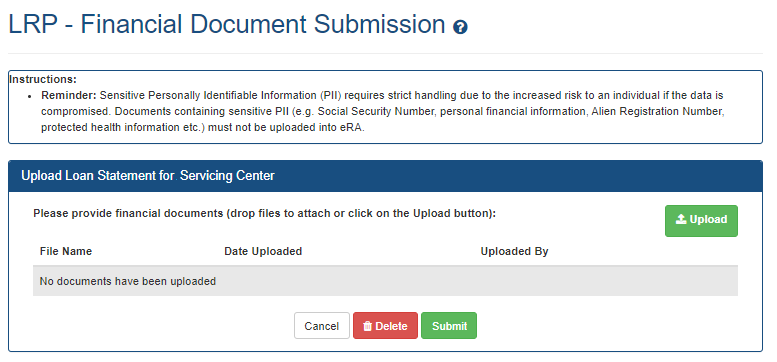

Credit: www.era.nih.gov

Types Of Long Range Plans

When a company thinks ahead, it crafts a roadmap for its future. This is where Long Range Plans (Lrp) in finance come into play. Companies set long-term goals and plan how to reach them. Let’s dive into two main types of long-range plans paving the way to financial success.

Strategic Financial Plans

Strategic financial plans are big-picture blueprints. They outline a company’s vision. Goals can take years to reach. This plan answers “What?” and “Why?” for long-term financial aims.

- Growth targets for sales and markets

- Investments in new projects or businesses

- Risk management to keep the company safe

These plans focus on where a company sees itself in the future. They are a guide for big decisions that shape the company’s destiny.

Operational Financial Plans

Operational financial plans get into the nitty-gritty. They deal with everyday actions and short-term goals. This plan is about “How?” to meet the strategies set by the strategic plan.

- Budgets for departments or projects

- Forecasts of sales and expenses

- Cash flow to keep things running smoothly

These plans turn the vision into steps. They are the day-to-day tasks and actions to make the vision real.

Components Of A Strong Lrp

Long Range Planning (LRP) is essential for sound financial health. A strong LRP includes accurate revenue forecasting, thorough cost analysis, and a clear investment strategy. These components help businesses prepare for the future, make smart financial decisions, and set realistic goals. Understanding each element is key to crafting an LRP that stands solid against uncertainties.

Revenue Forecasting

Revenue forecasting is predicting future sales. It maps out the expected income over a certain period. A strong LRP must have precise, data-driven forecasts. These estimates guide spending and growth plans.

- Historical data analysis

- Market trends study

- Prediction adjustment based on new information

Cost Analysis

Cost analysis helps see where the money goes. It splits expenses into categories. This view lets businesses manage costs better. A strong LRP uses this analysis to cut wasteful spending and optimize budgeting.

- Identify fixed and variable costs

- Evaluate cost-saving opportunities

- Monitor and adjust based on performance

Investment Strategy

Investment strategy outlines how to use profits to grow. It is crucial for a strong LRP. The strategy decides where to invest for the best returns. A diverse, risk-assessed plan is vital for long-term success.

| Asset | Timeframe | Expected Return |

|---|---|---|

| Stocks | 5-10 Years | High Risk, High Return |

| Bonds | 2-5 Years | Low Risk, Steady Return |

| Real Estate | 10+ Years | Medium Risk, Variable Return |

Credit: www.vecteezy.com

Lrp Execution Challenges

Long Range Planning (LRP) in finance is essential. But it’s tough to do right. Firms face big hurdles when they execute their LRP. Let’s dive into these challenges.

Aligning With Market Dynamics

Markets change fast. Keeping LRP in sync is hard. Firms must watch trends and adjust plans.Staying ahead requires agility and foresight.

Resource Allocation Struggles

Deciding where money and staff go is tricky. LRPs often fail when resources don’t match goals. It’s like a puzzle that firms must solve wisely.

Performance Tracking Obstacles

Measuring success over long periods is complex. Firms need good systems to track progress and stay on course. Without them, goals can get lost.

Best Practices In Lrp Formulation

Long Range Planning (LRP) is crucial for the financial health of an organization. It sets a roadmap for the future. Effective LRP positions a company to take advantage of opportunities. It also helps to navigate challenges. To ensure effectiveness, certain best practices must be followed.

Involving Stakeholders

Engaging stakeholders is essential when creating a Long Range Plan (LRP). Stakeholders provide insights and different perspectives. They highlight potential issues and offer solutions.

- Include team members from varied departments.

- Gather feedback from clients and investors.

- Regular meetings keep stakeholders involved.

Regularly Updating Lrp

LRPs cannot be static; they must evolve. Regular updates reflect market changes and internal shifts.

- Review LRP quarterly for best results.

- Adjust goals to align with current realities.

- Ensure strategic actions remain relevant.

Risk Management In Lrp

Risks can derail long-term plans. A robust LRP accounts for risks. It outlines strategies to manage them.

| Risk Type | Management Strategy |

|---|---|

| Market Risk | Diversification and Market Analysis |

| Operational Risk | Process Improvement and Contingency Plans |

| Financial Risk | Liquidity Reserves and Hedging Techniques |

Impact Of Technological Advancements

Technological advancements are reshaping finance. One area experiencing significant transformation is Loss Recovery Planning (LRP). Digital tools and data analytics are among the key drivers improving LRP strategies.

Lrp And Big Data Analytics

Big Data analytics revolutionizes LRP by offering deeper insights into risk management. Firms can predict financial setbacks more accurately. They use vast amounts of data to drive their LRP decision-making processes.

- Better risk assessment and management.

- Customized recovery strategies based on large data sets.

- Quicker identification of potential financial losses.

Software Tools For Lrp Efficiency

Diverse software tools have emerged to streamline LRP. They simplify complex calculations and automate laborious processes. Efficiency in LRP climbed remarkably thanks to these software solutions.

| Tool | Function |

|---|---|

| LRP Automation Software | Automates recovery scenario analysis. |

| Financial Reporting Tools | Generates real-time financial reports. |

| Simulation Programs | Tests various LRP strategies. |

These tools save time and reduce human error. They provide clear, actionable insights that firms can use to improve their LRP methodologies.

Frequently Asked Questions On What Is Lrp In Finance

What Does Lrp Mean In Finance?

In finance, LRP stands for “Loan Repayment Program. ” This refers to schemes designed to help individuals repay their loans.

What Is Lrp In Project Management?

LRP in project management stands for Long Range Planning. It involves strategizing for future projects and objectives over an extended time frame.

What Is Lrp In Marketing?

LRP in marketing stands for Loyalty Reward Program. It’s a strategy used by businesses to incentivize repeat customers by offering rewards for ongoing patronage.

What Is A Long Range Plan Finance?

A long-range financial plan outlines a company’s projected revenue and expenses over a multi-year period, guiding future financial decisions and goals.

What Is Lrp In Finance?

LRP stands for Liquidity Risk Premium, which refers to the extra return that investors demand for assets that cannot be easily converted into cash without a significant price discount.

Conclusion

Navigating the complexities of finance can be challenging, but understanding Lrp, or Liability-Related Pricing, is essential. It empowers businesses to strategize effectively when managing debts and investments. By grasping the nuances of Lrp, companies optimize financial operations, paving the way for sustainable growth and success.

Stay informed and make smart decisions for your financial future.