Individuals with only a high school diploma can pursue finance jobs such as bank teller, customer service representative, and collections agent. Other suitable roles include loan officer, financial clerk, and billing clerk.

Entering the financial field without a college degree might seem daunting, but there are various positions that offer a foray into this dynamic industry. A willingness to learn on the job and acquire specific certifications can open doors to prosperous career paths in finance.

Starting from entry-level positions, high school graduates have the potential to ascend through experience and dedication. These positions often provide foundational knowledge of financial processes, interaction with clients, and exposure to the banking system – valuable stepping stones for a rewarding financial career. Moreover, some institutions may offer further training or encourage the pursuit of advanced qualifications to help employees climb the career ladder.

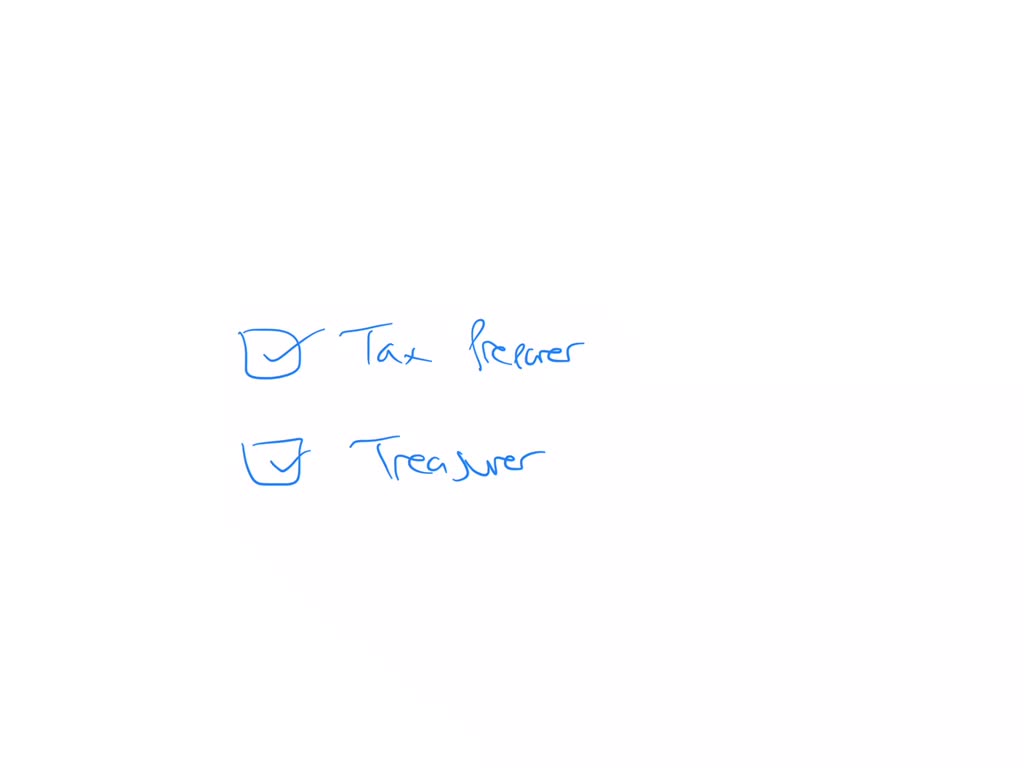

Introduction To Finance Career Paths With A High School Diploma

Think a career in finance requires a college degree? Think again! The finance sector offers various paths that don’t need a college diploma. A high school diploma can be your ticket to a rewarding financial career. From entry-level roles to positions that offer on-the-job training, the opportunities are vast.

Embracing A Wide Range Of Opportunities

Entry-level finance jobs are a stepping stone for high school graduates. With enthusiasm and hard work, climbing the ladder becomes possible. Let’s discover jobs you can land with just a high school education:

- Bank Teller – First point of contact in a bank, handling transactions.

- Customer Service Representative – Helps clients with financial inquiries.

- Collections Agent – Persuades clients to settle their overdue debts.

- Insurance Sales Agent – Sells insurance policies and advises clients.

The Importance Of Skills And Experiences

Success in finance jobs is not just about degrees. Skills and experiences play a critical role. High school graduates should focus on these areas:

| Skill Category | Skills to Develop |

|---|---|

| Numerical Skills | Basic math, budgeting, analyzing numbers |

| Communication Skills | Verbal and written communication, clarity, listening |

| Technology Skills | Computer proficiency, software applications |

| Interpersonal Skills | Teamwork, customer service, problem-solving |

Valuable experience can come from internships, volunteering, or even part-time jobs. These roles build your resume and open doors to new opportunities.

Credit: www.numerade.com

Bank Teller Roles

Embarking on a finance career without a college degree is possible with bank teller positions. These roles offer a critical entry point to the finance world for high school graduates. They lay the foundation of financial expertise.

Job Responsibilities

Bank tellers play a key customer service role in financial institutions. Primarily, they manage transactions and help clients with their banking needs.

- Processing deposits, withdrawals, and payments

- Maintaining and balancing cash drawers

- Answering clients’ questions and guiding them through services

- Carrying out bank opening and closing procedures

- Performing account maintenance activities

- Upholding privacy and security protocols

Path For Advancement

Bank tellers can climb the career ladder with hard work and dedication. Many tenured bank workers started as tellers.

- Acquire experience and develop a track record of success

- Seek professional certifications or additional training

- Express interest in more complex roles and responsibilities

- Take advantage of internal promotion opportunities

- Consider lateral moves to expand skills and knowledge

A career as a bank teller offers ample prospects for growth and development. It is a fitting launch pad into the finance industry for motivated individuals holding a high school diploma.

Entry-level Bookkeeping

Many think a college degree is a must for finance jobs. This is not always true. High school graduates can find opportunities in finance too. One such opportunity is in bookkeeping. Entry-level bookkeeping positions offer a solid start. They let you learn while you work.

Fundamentals Of Bookkeeping

What is bookkeeping? It’s recording a company’s financial transactions. This includes sales, purchases, payments, and receipts. Entry-level bookkeepers keep records up to date. They also help with financial statements.

- Track money coming in and out of a business

- Maintain accurate financial records

- Prepare basic financial reports

Certifications And Tools

No college diploma? You can still stand out in bookkeeping with certifications. Certifications show your skills and commitment.

Popular certifications include:

- Certified Bookkeeper (CB) from AIPB

- NACPB’s Licensed Bookkeeper (LB)

- QuickBooks certification

Bookkeepers also use software tools. Knowing software tools is a plus. Examples are:

| Tool Name | Use |

|---|---|

| QuickBooks | For managing accounting needs |

| Microsoft Excel | To sort and analyze data |

| Xero | For online accounting |

Credit: theartofapplying.com

Customer Service Representative In Financial Services

Imagine embarking on a rewarding financial career straight after high school. It’s possible as a Customer Service Representative in financial services. This role is crucial in any financial organization and provides a perfect starting point for those with a high school diploma.

Customer Interaction Skills

As a Customer Service Representative, your voice is the heart of the company. You will directly talk with clients every day. This job requires clear communication, patience, and empathy. Let’s delve into the key abilities you need:

- Active listening: Understand and address client concerns effectively.

- Problem-solving: Find quick and satisfactory solutions for clients.

- Communication: Explain complex information in simple terms.

Understanding Financial Products

Even without a college degree, you must grasp the basics of financial products. Knowledge is power in this role. Training is often provided, but a foundational understanding certainly helps:

| Product | Description |

|---|---|

| Savings Account | A basic banking service for clients to save money. |

| Credit Cards | Payment cards offering short-term loans. |

| Loans | Money lent to individuals or businesses to be repaid with interest. |

Sales Agent For Financial Products

Embarking on a career as a Sales Agent for Financial Products does not always require a college degree. With a high school diploma, one can navigate the competitive world of finance by selling various financial services and products. These range from insurance policies to mutual funds, retirement plans, and stocks. Let’s explore the essential skills and requirements for this role.

Developing Sales Acumen

To excel in financial product sales, developing a keen sales acumen is critical. Some essential skills include:

- Understanding customer needs and providing tailored solutions.

- Mastering the art of persuasion to close deals effectively.

- Building a strong network of contacts.

- Developing excellent communication and interpersonal skills.

- Analyzing market trends to stay ahead of the curve.

Regulations And Certifications

Although a college degree isn’t mandatory, understanding industry regulations and obtaining relevant certifications can be a game-changer for those in this field. Critical points to consider include:

| Regulatory Knowledge | Certifications | Benefits |

|---|---|---|

| Familiarity with financial regulations and compliance. | Securities licenses such as Series 6 or 7. State insurance licenses. |

Increases credibility. Enhances job prospects. |

Some positions may require specific licenses, which typically involve sponsored training from the hiring company and passing exams. Thus, even with a high school diploma, by investing time into the proper certification, one can spur their growth within the financial sales sector.

Personal Finance Advisor Assistant

Breaking into the finance sector with just a high school diploma may seem daunting. Yet, certain roles stand out as excellent starting points, such as the Personal Finance Advisor Assistant. This role serves as a stepping stone, offering a chance to observe financial strategies first-hand and grow practical skills.

Supporting Financial Advisors

Becoming a Personal Finance Advisor Assistant involves key responsibilities. Assistants play a critical part in the success of financial advisors. They handle administrative tasks, manage client communications, and organize meetings. Further, they prepare important documents, ensuring financial advisors can focus on crafting excellent financial plans.

- Manage appointment schedules

- Handle client queries and emails

- Prepare financial reports and presentations for meetings

Developing Personal Finance Knowledge

Starting as a Personal Finance Advisor Assistant lays a solid foundation for personal finance mastery. The job provides exposure to diverse financial tools and investment strategies. With time, assistants can learn about budgeting, saving, investing, mortgage planning, and retirement strategies.

Essential skills and knowledge gained in this role:

| Skill | Details |

|---|---|

| Budgeting Techniques | Understanding how to plan and track expenses |

| Investment Concepts | Learning about stocks, bonds, and funds |

| Retirement Planning | Assisting in long-term savings strategies |

Being proactive and eager to learn can turn this entry-level job into a powerful career launchpad in finance.

Credit: extension.harvard.edu

Frequently Asked Questions Of Which Finance Jobs Can Someone Pursue With Only A High School Diploma? Check All That Apply.

Which Finance Jobs Can Someone Pursue With Only A Highschool Diploma Brainly?

With only a high school diploma, individuals can pursue finance jobs such as bank teller, accounting clerk, billing clerk, loan officer, and financial customer service representative.

Which Job In The Finance Career Is Ideal For A Person Just Out Of High School?

An entry-level job such as a bank teller or junior accountant suits someone fresh from high school starting a finance career. These positions offer practical experience and industry insight, laying a foundation for future advancement.

Which Job In The Finance Career Is Ideal For A Person Just Out Of High School And Seeking On-the-job Training Brainly?

A teller position at a bank is ideal for high-school graduates seeking on-the-job training in the finance sector.

Which Job In The Finance Career Would Be Best For Someone Who Had Knowledge Of Banking And Credit Systems And The Ability To Repetitively Process Transactions?

A Loan Processor or Bank Teller position would best suit someone with banking and credit system knowledge and transaction processing skills.

What Finance Jobs Require No College Degree?

Entry-level finance jobs not requiring a college degree include bank teller, accounts payable clerk, billing clerk, loan officer, and collections agent.

Conclusion

Embarking on a finance career doesn’t always demand a college degree. High school graduates have a variety of options, from bank teller roles to payroll clerks. These positions provide a crucial stepping stone towards an enriching finance career path. As every role brings its own set of skills and experiences, starting early can pave the way for future success and advancement in the financial sector.