The First Foundation of Personal Finance is establishing an emergency fund. This foundational step ensures financial stability for unexpected events.

Managing personal finances effectively is critical for achieving long-term security and peace of mind. An emergency fund acts as a financial safety net, protecting you against life’s unpredictable occurrences such as medical emergencies, job loss, or major car repairs. Beginning with this fundamental principle allows individuals to build a solid financial base.

With an emergency fund in place, one can approach future financial decisions with greater confidence, knowing they have a buffer to address urgent financial needs without resorting to debt. Embracing this initial step sets the stage for a more resilient and flexible financial journey, laying the groundwork for prosperity and financial well-being.

The Essence Of Personal Finance

Personal finance forms the cornerstone of a secure, fulfilling life. It involves managing money, saving, and investing. It shapes how we meet life’s needs and goals. The first foundation of personal finance is understanding its essence. Knowledge and discipline guide wise money management. With solid financial footing, dreams become attainable.

Defining Personal Finance

Personal finance covers handling personal funds and planning for the future. It’s more than just spending. It’s about budgeting, saving, investing, and safeguarding resources. Smart finance ensures a better tomorrow.

Key Principles

- Income: Money that you earn from jobs, businesses, or investments.

- Budgeting: Planning how to spend your money wisely.

- Saving: Setting aside money for future needs or emergencies.

- Investing: Using money to make more money.

- Protection: Using insurance to guard against big financial risks.

Together, these elements form a sturdy financial foundation. They help you build wealth over time.

Credit: www.shoeboxed.com

The Bedrock: Budgeting

Budgeting stands as the cornerstone of personal finance. It’s the first step toward taking control of your financial destiny. A solid budget forms a clear picture of income versus expenses. It sets the stage for every financial decision and goal. Let’s dive deep into how to create a budget and explore the tools and strategies that can help manage it effectively.

Creating A Budget

Creating a budget begins with understanding your money flow. It’s like mapping a treasure hunt—it guides you to your financial goals.

- Track every dollar that comes in and goes out.

- Identify necessary expenses, like rent and groceries.

- Factor in periodic expenses, such as insurance payments.

- Set realistic savings goals for future dreams or emergencies.

- Adjust spending to not exceed income.

Tools And Strategies

To stay on top of your budget, various tools and strategies can streamline the process.

- Use apps designed for budget tracking.

- Employ spreadsheets for detailed views of your finances.

- Automate savings to ensure regular contributions.

- Regularly review and adjust your budget as needed.

Keep in mind, a budget is not set in stone. Life changes and so should your budget. Using these tools and strategies ensures continual adaptation to your financial situation.

Income Mastery

The cornerstone of personal finance is Income Mastery. Understanding how money flows into your life sets the stage for financial growth. It’s not just about earning but making those earnings work for you. Let’s dive deep into income and how you can master it to build a solid financial foundation.

Understanding Income Sources

To master your income, you must first understand where it comes from. Your job or business may be your primary source, but there are many ways to make money. Visualize your income as a stream with different tributaries.

- Salary from work

- Profits from business ventures

- Interest from savings

- Investment dividends

Each source contributes to your financial river. Realizing this helps you to tap into new streams and reinforce existing ones.

Maximizing Earnings

Once you know where your money comes from, the next step is to increase it. This means taking action to grow your income. Think of it as nurturing a garden to bear more fruit.

| Strategy | Description |

|---|---|

| Develop Skills | Learn new things to add value to your work and command higher pay. |

| Side Hustles | Start small projects on the side that can bring in extra cash. |

| Investments | Put your money in assets that can grow over time and pay dividends. |

Boosting earnings involves both active and passive strategies. Combining them can lead to a significant increase in your overall income.

Credit: prezi.com

Expenditure Control

Understanding the first foundation of personal finance starts with Expenditure Control. It’s about knowing where your money goes. Only then can you manage it wisely.

Tracking Spending

Track every penny that leaves your wallet. This habit unveils spending patterns. Use apps or a simple spreadsheet. By tracking, you identify where to make changes.

- List out all expenses daily.

- Review total spending weekly.

- Spot trends and irregularities.

Cutting Unnecessary Expenses

Eliminating extra expenses frees up cash. Start with subscriptions you rarely use. Cook at home more often than eating out. Remember, small savings add up.

| Before Cutting | After Cutting |

|---|---|

| Cable Subscription | Streaming Services Only |

| Daily Coffee Shop Visits | Home-Brewed Coffee |

Savings Tactics

Mastering your personal finances starts with one core principle: saving. It’s like building a dam in a river – the stronger it is, the safer you are during floods. To become a savings guru, you need strategies for both rainy days and sunny futures.

Building An Emergency Fund

An emergency fund is your financial lifeline. Life throws surprises, and not all are pleasant. A stash of cash keeps you afloat in rough times without sinking into debt.

Aim for three to six months’ worth of expenses. Start small, even a $5 weekly save makes a difference. Grow it over time.

Short-term Vs Long-term Savings

Balance is key. Split focus between short and long-term goals.

Short-term: Plan for purchases you’ll make in a few years. Could be a car or vacation.

Long-term: Think retirement and education. Longer to grow, so consider stocks or mutual funds.

| Type of Saving | Goals | Tools |

|---|---|---|

| Short-term | Upcoming purchases | Savings accounts, CDs |

| Long-term | Future stability | IRA, 401(k), stocks |

Credit: www.shoeboxed.com

Debt Management

The cornerstone of sound personal finance is debt management. It’s about knowing how much you owe and finding ways to pay it off. Effective debt management can mean the difference between financial freedom and endless money stress. Here are key aspects to consider:

Good Debt Vs Bad Debt

Understanding the types of debt is crucial. Let’s dive into what makes debt ‘good’ or ‘bad’:

- Good Debt – Invests in your future, like a student loan or a mortgage.

- Bad Debt – Buys depreciating assets, like credit card debt for luxury items.

Distinguishing these helps prioritize which debts to focus on first.

Strategies For Debt Reduction

To reduce debt, consider the following strategies:

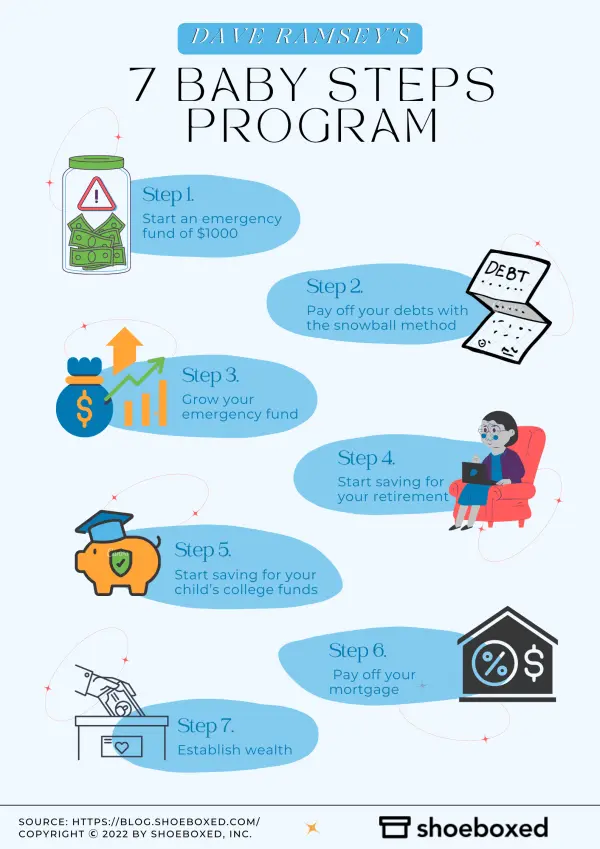

- Debt Snowball Method: Pay off the smallest debts first to build momentum.

- Debt Avalanche Method: Tackle debts with the highest interest rates first to save money over time.

Create a solid plan to become debt-free. Budgeting and regular financial reviews are vital. They keep you on track towards achieving your personal finance foundation.

Frequently Asked Questions For What Is The First Foundation Of Personal Finance

What Is A Foundation Personal Finance?

A foundation personal finance refers to the essential financial principles and practices that provide a base for sound money management and financial security.

What Is The First Rule Of Personal Finance?

The first rule of personal finance is to spend less than you earn. This fundamental principle helps you build savings and avoid debt.

What Are The 5 Foundations In Order?

The five foundations, in order, are: save a $500 emergency fund, pay off all debt using the debt snowball, save 3-6 months of expenses, invest 15% of household income into retirement, and save for your child’s college fund.

What Is The Second Foundation Personal Finance?

The second foundation of personal finance typically emphasizes building an emergency fund to cover unforeseen expenses.

What Defines Personal Finance Basics?

Personal finance refers to managing individual financial activities, including budgeting, saving, investing, and planning for retirement.

Conclusion

Understanding the first foundation of personal finance is crucial. It sets the stage for savvy money management and impacts future wealth. Succeeding in this area can often lead to a more secure and prosperous life. Hence, grasp this fundamental concept, apply disciplined financial practices, and watch your fiscal health strengthen over time.