Consumer finance accounts are financial instruments offered by companies to facilitate the purchase of goods and services on credit. They allow consumers to pay for items over time, often with interest.

Consumer finance accounts, essential tools in modern economic activity, empower customers to make purchases that might otherwise be beyond their immediate financial reach. These accounts can include various types of credit such as personal loans, retail installment contracts, and revolving credit plans like credit cards.

Retailers, banks, and dedicated finance companies often provide these financing options to enhance consumer purchasing power and stimulate sales. By offering a manageable payment structure, these accounts help bridge the gap between consumer desire and purchasing capability, supporting both economic growth and individual consumer needs. As a part of personal finance management, understanding and effectively utilizing consumer finance accounts can lead to improved credit scores and greater financial flexibility.

Credit: realbusiness.co.uk

Introduction To Consumer Finance Accounts

Consumer finance accounts are tools for managing personal spending and borrowing. They make buying easier for customers. Borrowing upfront and paying later is their main purpose. These accounts are in many shops and online. Use them for buying different things, like TVs or couches.

The Role In Modern Economies

Consumer finance accounts play a big part in economies today. They help stores sell more. They also let people buy bigger items without waiting. The economy grows when people buy more. The accounts make this happen. They are a bridge between wanting something and having it.

Examples Across Industries

- Retail: Stores offer cards for buying clothes, gadgets.

- Automotive: Dealers have loans for cars, trucks.

- Healthcare: Plans are there for medical, dental procedures.

- Home Improvement: Special accounts exist for furniture, renovations.

Types Of Consumer Finance Accounts

Understanding the different types of consumer finance accounts helps in managing money better. It explains how we pay for things we buy. Some help buy things now and pay later. Others let us pay slowly over time. Let’s look at these accounts.

Credit Cards And Loans

Credit cards give you the power to buy now and pay later. They are like short loans. You use the card and then pay back with interest. The types of credit cards include:

- Standard Cards – For everyday purchases.

- Rewards Cards – You get points or cash back.

- Balance Transfer Cards – Move debt to save on interest.

Loans are for when you need lots of money at once. You can borrow and then pay it back slowly. Many kinds of loans exist, like:

- Personal Loans – Use for almost any reason.

- Auto Loans – Help buy a car.

- Home Loans – Known as mortgages, to buy a house.

Retail Finance And Payment Plans

Retail finance is money help from stores. They let you buy with a plan called layaway or financing. Big stores offer cards just for their place. Payment plans break up your bill. It makes it easier to afford expensive things. You might see:

- Layaway – Pay off before you get the item.

- 0% Financing Offers – No interest for a set time.

- Installment Plans – Pay in parts over a few months.

Benefits To Consumers

Consumer finance accounts offer unique benefits to shoppers. These perks make buying and managing finances smoother than ever.

Enhanced Purchasing Power

The beauty of consumer finance accounts lies in their ability to boost buying abilities. Shoppers enjoy the freedom to purchase big-ticket items without the immediate stress of full payment.

- Immediate Ownership – Take home your dream product now.

- Payment Flexibility – Split costs into manageable chunks over time.

- Special Offers – Access to exclusive deals and promotions.

Credit Building Opportunities

Consumer finance accounts aren’t just for immediate benefits — they’re also a credit-building tool.

- Track Record – Establish a history of punctual payments.

- Score Increase – Positive activity boosts credit scores.

- Future Benefits – A stronger credit profile opens doors to lower interest rates.

Credit: ficoforums.myfico.com

Risks And Considerations

Understanding consumer finance accounts is essential. These accounts let you buy things and pay over time. But, like any financial commitment, they come with risks and considerations. It is crucial to know these before opening an account.

Interest Rates And Financial Charges

Interest rates and financial charges can add to the cost of purchases. High rates can lead to high bills. Low rates can help save money. Always check the rates before you sign up.

Besides interest, some accounts have extra fees. Look out for:

- Late payment fees: Costly if you miss payments.

- Annual fees: Some accounts charge yearly.

- Transaction fees: Charged on certain purchases.

| Account Type | Interest Rate | Annual Fee |

|---|---|---|

| Credit Card | Variable | May Apply |

| Store Card | Fixed or Variable | Rarely Applies |

Impact On Credit Scores And Debt

Using consumer finance accounts impacts credit scores. Positive or negative, depends on use. Good habits can improve scores. Bad habits can hurt scores.

Factors that affect scores include:

- Payment History: On-time payments help scores.

- Credit Utilization: Low usage is good for scores.

- Length of Credit History: Longer is better for scores.

- New Credit Applications: Too many can drop scores.

Debt levels are another concern. High balances lead to more debt. More debt can lead to financial stress. Aim for balances that are manageable.

Consumer Protection And Regulations

When you borrow money, buy on credit, or get a loan, you deal with consumer finance accounts. These are also known as financial services or consumer credit. Smart rules keep them safe for everyone. These rules make sure companies treat you right. They also help keep your money safe. Each rule is like a helmet when riding a bike, it protects you.

Federal And State Oversight

Bold agencies watch over consumer finance accounts. They act like guardians. Their job is to make sure companies follow the rules. Together, they use a big magnifying glass to spot any trouble. This magnifying glass is the law.

Here are some key players in bold:

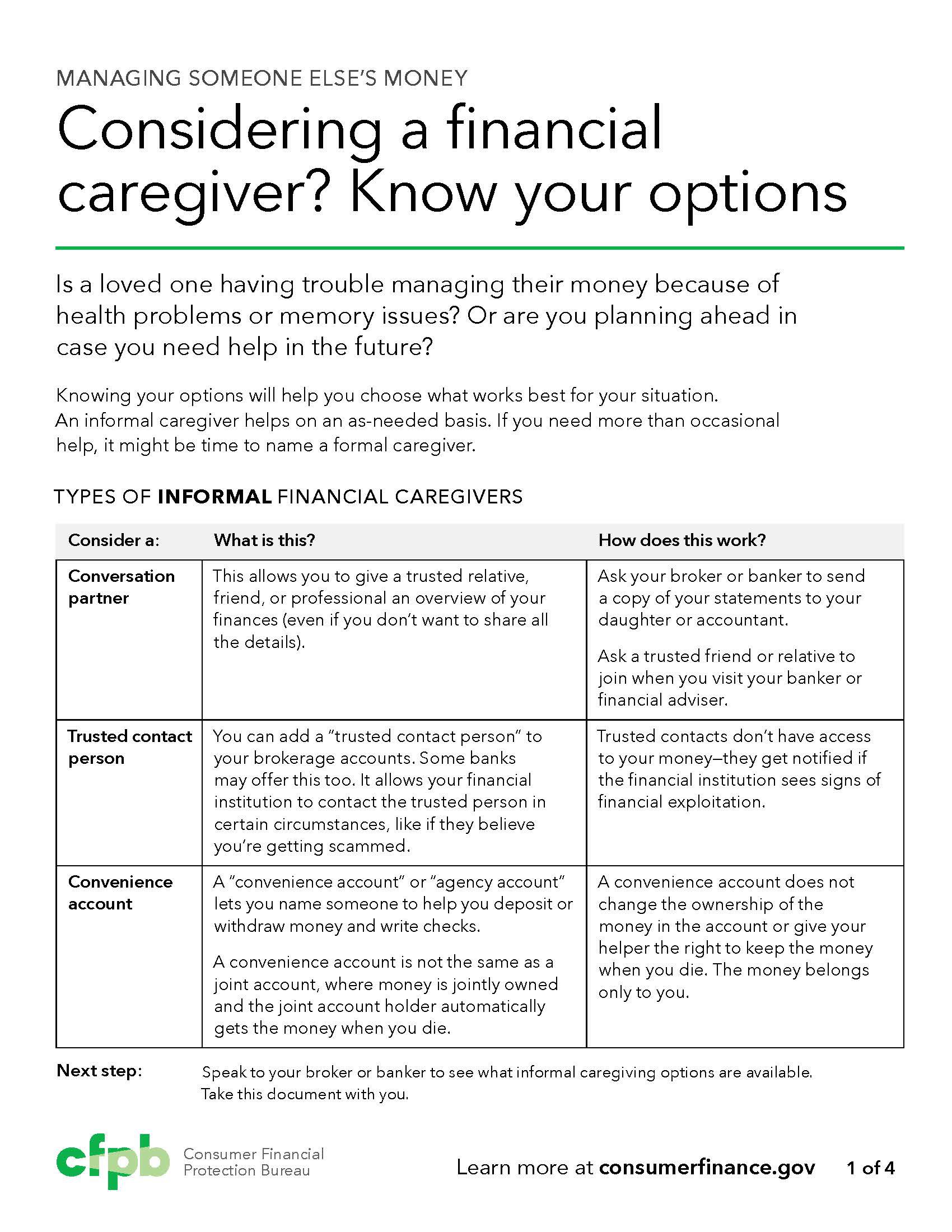

- Consumer Financial Protection Bureau (CFPB): They are the captains. They keep an eye on banks and lenders.

- Federal Trade Commission (FTC): They make sure ads and sales are true.

- State agencies: They have their own set of rules closer to home.

Key Legislation And Its Impact

Important laws build a strong fence to keep your money safe. These laws have big names but simple goals. They tell companies, “You must be clear and fair.”

Let’s look at these bold laws:

| Law | What It Does |

|---|---|

| Truth in Lending Act (TILA) | Makes sure you know all about your loan. |

| Fair Credit Reporting Act (FCRA) | Protects your credit information. |

| Fair Debt Collection Practices Act (FDCPA) | Stops collectors from being unfair or mean. |

These laws have power. They change the way companies work with you. They make sure you can trust your money with these companies.

The Future Of Consumer Finance

Consumer finance is transforming fast. People buy things differently now. They also borrow money in new ways. This change is exciting! Let’s explore what this means for all of us.

Technological Advancements

Technology is making finance easier. You will see new tools that help you manage money better. Think about apps that show you how to save. Or robots that give you advice. This is the future we’re stepping into.

- Mobile Payments: Pay with your phone, no wallet needed.

- Online Loans: Get money without visiting a bank.

- AI Financial Advisors: Robots that plan your money life.

Trends Shaping The Consumer Finance Landscape

Change is constant in consumer finance. It’s not just about technology. It’s how we think about money. People want control and comfort. They prefer simple and secure ways to handle finances.

| Trend | What It Means |

|---|---|

| Green Finance | Money choices that help the earth. |

| Personalization | Services designed for you, not everyone. |

| Financial Literacy | Learning to make smart money moves. |

Credit: www.consumerfinance.gov

Frequently Asked Questions For What Are Consumer Finance Accounts

What Does To Many Consumer Finance Company Accounts Mean?

Having too many consumer finance company accounts typically indicates a person holds numerous lines of credit with specialized lending institutions, which could negatively impact their credit score.

How Long Do Consumer Finance Accounts Stay On Credit Report?

Consumer finance accounts typically remain on a credit report for seven years. They reflect both positive and negative payment history, influencing credit scores.

What Are Considered Consumer Accounts?

Consumer accounts refer to personal banking and financial accounts held by individuals for managing savings, checking, credit, and investments, as opposed to business or corporate accounts.

What Do You Mean By Consumer Finance?

Consumer finance refers to loans and other financial products designed for individuals to purchase goods and services, often involving repayments with interest over time.

What Is A Consumer Finance Account?

A consumer finance account is a type of financial account that offers credit facilities to individuals for purchasing consumer goods and services.

Conclusion

Navigating consumer finance accounts can transform your financial health. They offer flexible options for purchases and budget management. Remember, informed choices lead to credit score improvements and potential savings. Start exploring these tools to enhance your fiscal journey and secure your economic future.

Embrace the power of savvy spending and investing.