SBC in finance stands for Small Business Credit. It refers to credit, loans, and financial services designed specifically for small businesses.

Understanding Small Business Credit (SBC) is crucial for entrepreneurs aiming to start or expand a business. With the need for capital to fuel growth, SBC serves as the financial support that entrepreneurs can leverage to cover expenses, invest in new projects, or smooth out cash flow fluctuations.

Securing credit is often a top priority for small businesses looking to gain a competitive edge in the market. The ability to secure funding from banks, credit unions, or online lenders can make a significant difference in the operations and longevity of a small company. As such, SBC is an integral part of financial planning for small enterprise owners who must navigate the lending landscape effectively to establish and grow their businesses.

Credit: www.coastalcarolina.edu

The Role Of Sbc In Finance

Share-Based Compensation (SBC) is crucial in finance. It rewards employees for their hard work. Companies give shares or cash as a thank you. This helps keep talented people in a company. It also links their success to the company’s success.

Defining Share-based Compensation

SBC is when companies give shares to employees. This is part of their pay. Employees work harder hoping the share price will go up. Over time, this can be worth a lot of money. Both big and small companies use SBC. It’s a smart way to pay people.

Types: Equity Vs Cash

There are two main types of SBC: equity and cash. Let’s explore each type.

Equity-Based SBC- Employees get company shares.

- Value grows with the company.

- Can include stock options and restricted stock.

- Employees get cash linked to share value.

- They don’t get actual shares.

- Paid as bonuses or part of salary.

In both ways, employees feel part of the company’s future. Companies decide which type fits best for them. It depends on their goals and the employee’s role.

Key Features Of Share-based Compensation

Share-Based Compensation (SBC) is a powerful tool for businesses to motivate and retain employees. This form of payment allows employees to share in the company’s success. Below are vital elements that make SBC a unique and valuable form of employee reward.

Valuation Methods

One of the key factors of Share-Based Compensation is the method used to value the shares or options. Companies can choose from several valuation methods. These methods gauge the worth of the share-based payments. The most common methods include:

- Black-Scholes Model – A formula calculates the option’s value based on factors like stock price, volatility, and time to expiration.

- Binomial Model – It uses a tree of possible stock prices to derive values for options at each node in the tree.

- Monte Carlo Simulation – A complex model that uses random sampling to determine the value of options.

Vesting Periods And Conditions

Vesting periods are critical in SBC plans. They incentivize employees to stay with the company. Companies often set specific conditions for vesting. This generally includes a time-based schedule or performance milestones. Common vesting conditions include:

| Vesting Type | Condition |

|---|---|

| Cliff Vesting | All shares vest after a certain period. |

| Graded Vesting | Shares vest gradually over time. |

| Performance-based Vesting | Shares vest upon achieving goals. |

These features ensure that SBC aligns employee interests with those of the company. Both valuation methods and vesting conditions play pivotal roles in the strategic implementation of Share-Based Compensation.

Benefits Of Sbc For Corporations

Share-based compensation (SBC) is a powerful tool for companies. It helps them reward employees. It also ties their rewards to the company’s success. This method has several advantages. These can improve corporate performance and employee engagement.

Attracting And Retaining Talent

Companies always want the best employees. To get them, they need to offer something special. SBC is one of those special things. It makes a job offer more attractive. Employees feel they own a part of the company. Here are some key perks of using SBC to secure top talent:

- Motivation boost – Workers strive for company growth.

- Commitment lift – Employees tend to stay longer with the company.

- Reduced turnover – This lessens the need to find and train new talent.

Tax Advantages

Beyond just talent, SBC offers tax benefits. Both companies and employees can gain. Here are the main tax-related benefits for corporations:

- Deduction opportunities – Companies can often deduct SBC from their taxes.

- Deferred taxation – Some SBC plans delay taxes until the benefit is received.

- Lower payroll taxes – SBC can result in lower payroll taxes compared to regular salaries.

Credit: www.appeconomyinsights.com

Sbc From The Employee’s Perspective

Understanding Stock-Based Compensation (SBC) is pivotal for employees. It refers to the practice of companies rewarding their personnel with equity. This includes options to buy company stock at a reduced rate or actual shares. Employees need to grasp the true value SBC can add to their financial portfolio.

Wealth Building Opportunities

- Ownership in the company.

- Potential for significant financial gains.

- Shape financial future with company success.

- SBC aligns personal goals with company goals.

SBC grants are unique. They offer a chance to grow wealth alongside the employer. They enable employees to reap direct benefits from their hard work. Over time, as the company flourishes, so does the value of SBC. This creates an attractive financial opportunity for employees invested in their company’s success.

Risks And Considerations

- Vulnerability to market fluctuations.

- SBC may come with a vesting schedule.

- Over-reliance on one company’s stock is risky.

- Tax implications must be considered.

While SBC carries promise, employees must recognize potential downsides. Stock prices can fall, affecting SBC’s value sharply. There are also restrictions, known as vesting periods, which dictate when employees can sell their stock. Diversifying investments is crucial to mitigate risks associated with SBC. Finally, employees should seek advice to navigate tax liabilities related to their stock compensation.

Accounting For Sbc

Accounting for Share-Based Compensation (SBC) stands as a crucial aspect of financial management. Businesses often provide SBC to employees as part of their compensation package. Understanding how to account for these expenses is vital for accurate financial reporting.

Financial Reporting Standards

Companies must follow strict accounting standards when reporting share-based compensation. These standards ensure transparency and comparability across different entities. Key frameworks like the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP) in the United States provide guidelines on SBC accounting treatments.

Expense Recognition And Measurement

Recognizing and measuring SBC expenses involve two crucial steps. First, companies must identify the fair value of share-based payments. Second, they should recognize this value as an expense over the vesting period. Precise measurement is essential for reflecting the true cost of employee compensation on a company’s financial statements.

The process is as follows:

- Determine the fair value of the equity instruments at grant date.

- Spread the cost over the period in which employees earn the benefits.

- Adjust for changes in the number of instruments expected to vest.

The table below illustrates how a company would account for SBC over a three-year vesting period:

| Year | Expense Recognized |

|---|---|

| 1 | Fair value of shares/3 |

| 2 | Accumulated value over two years/3 |

| 3 | Total fair value of shares vested |

Credit: kailashconcepts.com

Recent Trends And Innovations In Sbc

Share-based compensation (SBC) has evolved dramatically in recent years. This evolution reflects deep changes in the economy, technology, and how companies operate. Recent trends and innovations have pushed SBC practices from the backgrounds of company finance operations to the forefront of strategic planning and employee retention mechanisms.

Influence Of Startups

Startups stirred a significant shift in SBC. They extensively use stock options to attract talent. Big companies have noted this. They now weave SBC into their compensation structures. Innovative SBC models cater to employee needs, alongside cash pay. This approach helps startups compete with larger firms.

- Stock options and ESOPs are popular in SBC strategies.

- Dynamic equity splits provide flexibility over time.

- Vesting schedules keep talent committed to company growth.

Emerging Markets And Global Practices

Emerging markets have introduced new dynamics into the SBC landscape. As firms globalize, SBC becomes more complex. Firms must now adapt their SBC practices to multiple legal systems and tax regimes. This complexity leads to innovations in strategy and management of share-based compensation. Technology drives these innovations.

| Country | Innovation in SBC | Impact |

|---|---|---|

| China | Digital equity tools | Streamlines SBC management |

| Brazil | Regulatory alignment | Facilitates cross-border SBC |

| India | Automated compliance | Reduces operational risk |

Cloud-based SBC platforms provide real-time data analytics. Digital ledger technologies ensure transparent equity management. These tools help companies navigate global SBC practices with ease.

Frequently Asked Questions On What Is Sbc In Finance

What Does Sbc Stand For In Finance?

SBC in finance stands for “Standby Credit,” which is a type of financial guarantee for loans and obligations.

How Is Sbc Expense Calculated?

SBC expense, or Share-Based Compensation expense, is calculated by assessing the fair value of the equity awarded and recognized over the vesting period of the shares.

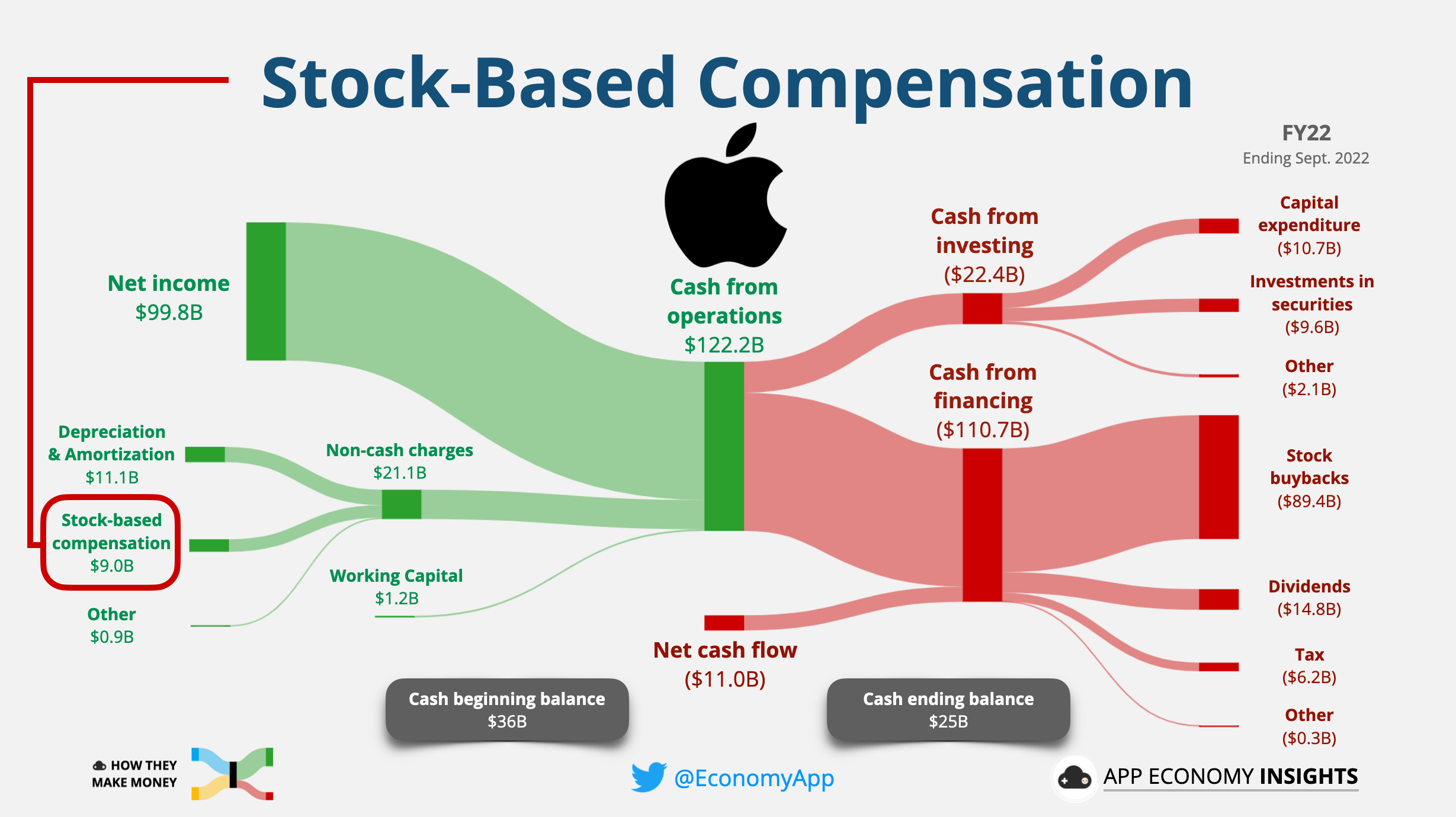

What Is Sbc In Cash Flow Statement?

SBC in a cash flow statement stands for Stock-Based Compensation. It represents costs associated with awarding shares to employees or executives.

What Is Sbc Investing?

SBC Investing, or Small Business Crowdfunding Investing, allows individuals to invest in startup and early-stage companies through online platforms. This type of investment can offer high growth potential but also poses significant risks.

What Does Sbc Stand For In Finance?

SBC in finance stands for “Standby Letter of Credit,” which is a guarantee of payment issued by a bank on behalf of a client.

Conclusion

Understanding SBC in finance gives you a clearer view of your financial standing. It’s essential for assessing business costs, taxes, and insurance policies. By mastering SBCs, you enhance financial transparency. Embrace this knowledge to make smarter fiscal decisions, ensuring a robust financial future.