EAC in finance stands for Estimated Annual Cost, which is a projection of yearly expenses. It encompasses all costs associated with an investment or project over one year.

Understanding EAC is crucial for investors and businesses as it aids in budgeting and financial planning. This projection helps in comparing the long-term value of various investments by providing a standardized annual figure. By considering expenses like maintenance, operation, and potential future costs, EAC offers a comprehensive view of the financial implications of investment decisions.

It acts as a guide to ensure that funds are effectively allocated and that projects stay within their financial boundaries, ultimately supporting sustainable financial growth and stability. For anyone involved in managing finances, whether for personal investments or corporate projects, grasping the concept of EAC is an essential step towards achieving financial accuracy and avoiding unforeseen expenses.

Eac: Decoding The Acronym In Finance

Finance loves acronyms, and one you might see is “EAC”. EAC stands for Estimated Annual Cost. It lets businesses predict costs over a year. It helps in budgeting and decision-making. Let’s break it down.

Breaking Down EACBreaking Down Eac

EAC calculates the annual cost of owning or maintaining an asset. This includes all expenses, like purchase price, maintenance, and operation costs. The formula combines initial cost with ongoing expenses. Understanding EAC is crucial for long-term planning.

Table displaying elements of EAC for clarity| Element | Description |

|---|---|

| Initial Cost | Price to buy an asset. |

| Maintenance | Regular upkeep costs. |

| Operation | Cost to use the asset. |

Eac’s Place In Financial Management

Financial management uses EAC in several ways:

- Budget Planning: Predicts yearly costs, helps avoid surprises.

- Investment Analysis: Compares costs across investments for better decisions.

- Cost Comparison: Helps see assets’ true costs for smart spending.

EAC is a valuable tool. It keeps finances in check. It’s essential for strategizing and staying cost-effective.

Credit: www.getrodeo.io

Calculating Eac: A Primer

Equated Annual Cost (EAC) is a critical financial figure used to compare projects with differing lifespans. Understanding how to calculate EAC allows for better long-term investment decisions. Let’s dive into the world of EAC with an easy-to-follow breakdown.

Components Of Eac Calculation

EAC takes three main factors into account:

- Initial Costs

- Annual Operating Costs

- Residual Value

Each component plays a vital role in determining the true yearly expense of an investment.

A Step-by-step Guide

Calculating EAC can seem complex, but by breaking it down into small steps, it becomes manageable. Here’s a straightforward guide:

- Identify all initial costs tied to the project.

- Add up annual operating costs, including maintenance and utilities.

- Estimate the project’s lifespan and its residual value at the end.

- Calculate the present value of the costs and the residual value using the discount rate.

- Divide the present value of the costs by the present value of an annuity factor.

- The result is your EAC, the yearly cost of owning and operating the investment.

This method simplifies comparing projects with different lifespans and costs. It focuses on finding a levelized cost for easier decision-making.

| Step | Task | Outcome |

|---|---|---|

| 1 | Initial Costs | Project’s starting point |

| 2 | Annual Costs | Recurring expenses |

| 3 | Residual Value & Lifespan | End-of-life forecast |

| 4 | Present Value Analysis | Costs made comparable |

| 5 | EAC Calculation | Your annual cost metric |

EAC shines a light on financial planning. It eases the process of making informed investment choices.

The Importance Of Eac In Budgeting

Understanding Estimated at Completion (EAC) is key in financial planning. EAC offers a realistic view of project costs. This helps to set budgets that reflect actual spending needs. Companies gain insights into total project expenses. This ensures that financial strategies stay on track.

Forecasting Long-term Costs

EAC plays a crucial role in predicting future expenses. This forecast guides teams in long-term planning. It reduces the risks associated with budget overruns. Firms can allocate resources more effectively. They transform guesswork into data-driven decisions.

- Prepare for future expenses

- Keep projects within budget

- Mitigate financial risks

Enhancing Budget Accuracy

Accurate budgets mean better financial health. EAC helps refine these budgets. It identifies trends and changes in costs. With EAC, financial teams update budgets with confidence. They make adjustments that reflect true project needs. This accuracy prevents financial surprises down the line.

- Analyze cost trends

- Update budget forecasts

- Avoid unexpected costs

Comparing Investment Options With Eac

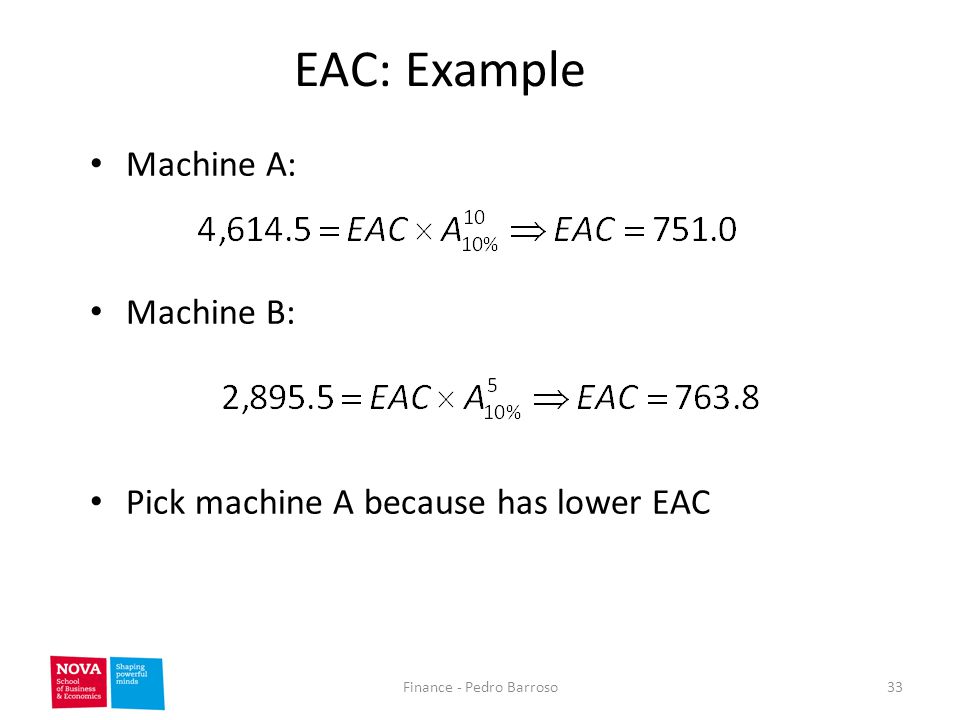

When choosing where to put money, a smart tool is EAC, or Equivalent Annual Cost. This method helps compare different investment choices. It considers all costs over time to find the best option. Let’s explore how EAC works in picking investments.

Analyzing Comparative Costs

EAC helps to see what an investment really costs each year. It makes comparing different options easy. For instance, two machines might have different prices and lifespans. EAC shows which one is cheaper in the long run.

Here is how to look at costs:

- Initial investment: The starting cost of an option.

- Maintenance costs: Money needed to keep things running smoothly.

- Resale value: What you get back when you sell the investment.

To find the EAC, add all costs then divide by the number of years. A lower EAC means less cost annually.

| Investment Option | Initial Cost | Maintenance (Yearly) | Resale Value | EAC |

|---|---|---|---|---|

| Machine A | $10,000 | $500 | $2,000 | $1,300 |

| Machine B | $12,000 | $300 | $3,000 | $1,150 |

The table shows Machine B has a lower EAC and is more cost-effective.

Eac In Decision-making

EAC guides in picking the best investment, it’s more than just the cost. It includes every expense and gain during an investment’s life.

Consider these points with EAC:

- Long-term benefits: Think about gains over many years.

- Cost changes: Will costs go up or down? Plan for these.

- Investment goals: Your end goal affects which choice is right.

Use EAC as a part of your whole decision process. It’s one piece of the puzzle. EAC makes sure you don’t pay too much year after year.

Common Pitfalls In Eac Analysis

Understanding the Equivalent Annual Cost (EAC) is crucial in financial decision-making. Yet, pitfalls await the unwary. EAC analysis offers insights into the long-term cost efficiency of investments. Falling into certain traps can lead to wrong choices. Let’s look at common errors and how to avoid them.

Avoiding Calculation Errors

EAC calculations can be complex. They must factor in the asset’s lifespan, maintenance, and disposal costs, among others. Simple mistakes can lead to significant errors. Here’s what to watch out for:

- Mixing up cash flows: Ensure correct timing of each cash flow.

- Incorrect discount rate: Use a rate that reflects risk and time value of money.

- Forgetting expenses: Include all relevant costs over the asset’s life.

Use spreadsheets wisely. Double-check formulas and seek peer reviews to catch errors early.

Interpreting Results Correctly

Correct interpretation of EAC results is as important as accurate calculations. Misunderstandings can misguide financial strategy. Consider these key aspects:

- Context matters: Analyze results in the asset’s usage context.

- Comparative basis: EAC should compare similar types and durations of asset use.

- Risk assessment: Factor in uncertainties and their impact on costs.

Treat EAC as one part of a bigger financial picture. Integrate it with other analysis methods.

Credit: slideplayer.com

Eac In Action: Case Studies

Understanding EAC, or Estimated At Completion, is like having a financial crystal ball. It shows what project costs might be when the dust settles. The concept comes to life through real-world examples.

Let’s look at EAC through the lens of case studies. These stories show us the towering value of EAC in action.

Real-world Examples

Consider a construction project. It started with a budget at $5 million. Six months in, expenses have reached $3 million. Work is half done.

EAC steps in to predict the end cost. Let’s do the math:

The project’s performance index is 0.8. This means it’s running over budget. We multiply the original budget ($5 million) by the performance index (0.8).

The result? An EAC of $6.25 million. The project needs tighter budget control.

Learning From Industry Practices

Industry leaders use EAC for a competitive edge. They compare projected and actual costs to stay in the green zone. Let’s study a tech company’s approach.

- Initial Budget: $2 million for software development

- Cost Variance: After one year, they’ve spent $1.25 million but only completed 40% of the work.

- Action Taken: EAC predicts a total cost of $3.125 million.

- Outcome: The company revises strategies to cut unnecessary features, saving costs.

The EAC figure guided the company to make crucial decisions, avoiding a budget crisis. This example teaches the power of forecast and adjustment.

Credit: financeformulas.net

Frequently Asked Questions For What Is Eac In Finance

How Is Eac Calculated?

EAC is calculated by dividing the project budget by the cost performance index (CPI). It forecasts total project cost based on current performance.

How Do You Find Eac In Finance?

To find the Equivalent Annual Cost (EAC) in finance, divide the Net Present Value (NPV) of a project by the present value of an annuity factor. This calculation provides the annual cost of owning and operating an asset over its life span.

What Does Eac Mean In Investment?

EAC stands for Estimated Annual Cost, a projection of yearly expenses associated with an investment, including management fees and operating costs.

What Is The Difference Between Eac And Npv?

EAC (Equivalent Annual Cost) calculates the annual cost of owning and operating an asset over its entire life. NPV (Net Present Value) assesses a project’s profitability by comparing present incoming and outgoing cash flows. They differ in purpose: EAC for cost comparison, NPV for investment profitability.

What Does Eac Mean In Finance?

EAC stands for “Estimated Annual Cost” in finance, referring to the projected annual cost of funding an investment or project.

Conclusion

Understanding EAC, or equivalent annual cost, is crucial for financial decision-making. It helps in comparing projects with differing lifespans and costs effectively. By mastering EAC calculations, individuals and businesses can optimize their investments and expenses, ultimately leading to better financial health and smarter resource allocation.

Remember, a firm grasp of EAC can lead to wiser financial choices and sustainable success.