Majoring in finance offers analytical skills and financial literacy essential for a variety of high-demand careers. It prepares students for strategic decision-making in business environments.

Choosing to major in finance can pave the way for a rewarding career, providing individuals with a robust understanding of fiscal dynamics and market behavior. Those who specialize in finance learn to navigate the complexities of financial systems, analyze economic trends, and manage investments.

This skill set is invaluable in a world where financial acumen translates into organizational success. A finance degree equips students with the tools to evaluate and optimize assets, whether working for multinational corporations, start-ups, or non-profits. The curriculum typically covers a wide range of topics, including accounting, statistics, economics, and financial modeling, ensuring a comprehensive education. Graduates with a finance degree are well-positioned to secure roles in banking, financial planning, corporate finance, or investment analysis, making this major a strategic choice for future growth and stability.

The Strategic Role Of Finance In Business

The strategic role of finance in business cannot be overstated.

Financial acumen drives company growth, with experts playing a vital part in decision-making.

Without a strong financial foundation, businesses struggle to thrive in competitive markets.

Core Functions Of Financial Professionals

Financial professionals are the backbone of any successful business.

They handle critical tasks that keep companies financially healthy.

- Budgeting – They craft plans for spending.

- Forecasting – They predict future finances.

- Analysis – They turn data into insights.

- Risk Management – They protect assets.

- Advising – They guide business decisions.

Influence Of Financial Expertise On Business Success

Business success heavily relies on finance experts.

Their analysis and insight often lead to better strategic decisions.

| Area of Influence | Impact |

|---|---|

| Investment Decisions | Choose profitable ventures. |

| Operational Efficiency | Cut costs, maximize profits. |

| Financial Health | Ensure sustainability, growth. |

Finance experts turn goals into realities by aligning finances with business strategies.

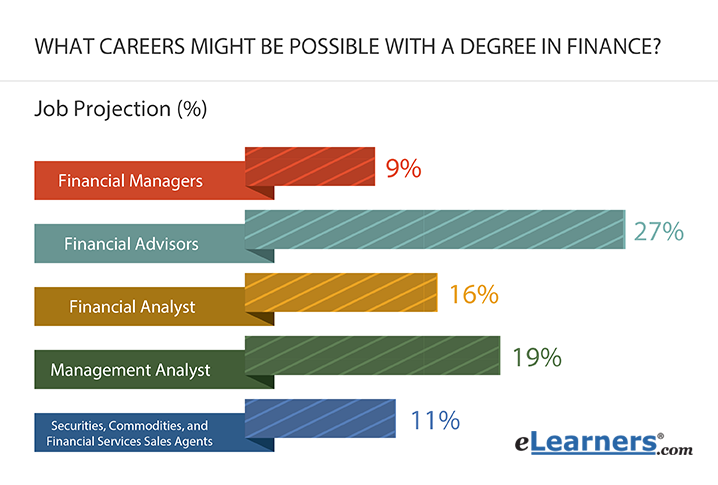

Credit: www.elearners.com

Diverse Career Paths Within Finance

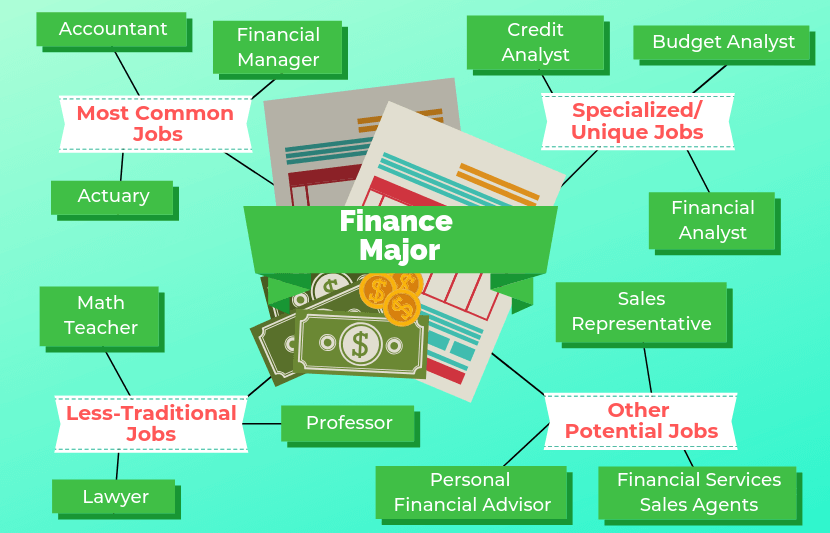

Choosing a major in finance opens a door to a wide array of rewarding career paths. Each path offers unique opportunities to apply financial knowledge. With the right education and skills, the finance industry provides a ladder that can lead you from entry-level positions to high-profile roles. Explore the potential of a finance career and envision a path that aligns with your passions and goals.

From Analyst To Cfo: A Career Progression

Embarking on a finance career can start at the analyst level. Aspiring professionals build expertise through hands-on experience. The journey is structured with clear milestones leading to executive positions. Achieve career growth as you master the financial landscape. Consider the typical trajectory:

- Financial Analyst: Gain a solid foundation analyzing financial data.

- Senior Financial Analyst: Take on larger projects and develop specialized skills.

- Finance Manager: Manage teams, budget, and financial strategies.

- Director of Finance: Oversee department operations and contribute to executive decisions.

- Chief Financial Officer (CFO): Lead the organization’s financial functions at the highest level.

Specializations: Investment Banking To Personal Finance

Finance careers vary wildly, offering something for everyone. Each specialization demands a unique skill set. Explore areas like investment banking, risk management, and personal finance advising. Here’s a glimpse of potential paths:

| Specialization | Skill Set Required | Career Opportunities |

|---|---|---|

| Investment Banking | Valuation, Financial Modeling | Investment Banker, Private Equity Analyst |

| Risk Management | Quantitative Analysis, Decision Making | Risk Manager, Compliance Officer |

| Personal Finance | Communication, Empathy | Personal Financial Advisor, Wealth Manager |

| Corporate Finance | Strategic Planning, Cash Flow Management | Financial Analyst, Finance Director |

Each area of finance harnesses different talents. Identify your strengths and choose a focus. Match your interests with the right financial specialization. Embark on a career journey that fulfills your ambitions.

Foundational Skills Gained In A Finance Major

Choosing a major in finance sets a solid foundation for students. It sharpens essential skills that apply to numerous careers. Below we explore some key skills that a finance major develops.

Analytical And Quantitative Proficiencies

In a finance major, students learn to analyze complex data with precision. They hone their skills in:

- Mathematics: Grasping advanced algebra and calculus for financial calculations.

- Statistics: Interpreting data to predict financial trends and risks.

- Problem-Solving: Navigating fiscal challenges and finding effective solutions.

These skills help them excel in high-stakes decision-making environments.

Understanding Of Financial Markets And Instruments

Knowledge of markets and instruments is crucial for finance majors. They become well-versed in:

- Stocks & Bonds: Evaluating investment options and their potential returns.

- Global Markets: Understanding the global impact on finance.

- Financial Laws: Learning regulations to ensure compliance.

This understanding is pivotal for navigating the financial landscape.

Credit: www.tun.com

The Potential For High Earnings

The world of finance often promises lucrative career opportunities. Aspiring professionals dream of hefty paychecks that potentially come with a major in finance. Indeed, the financial sector stands out for its robust salary offerings, often far surpassing averages in other fields. A finance degree opens doors to a range of high-paying roles, each with its own unique rewards.

Salary Prospects In Different Finance Roles

Finance majors have diverse career options, each with attractive pay scales. Below, we explore several popular finance roles and their typical salaries:

| Finance Role | Entry-Level Salary | Mid-Career Salary | Experienced Salary |

|---|---|---|---|

| Investment Banker | $85,000 | $125,000 | $200,000+ |

| Financial Analyst | $55,000 | $65,000-$80,000 | $100,000+ |

| Financial Manager | $90,000 | $120,000 | $150,000+ |

| Accountant | $50,000 | $70,000 | $90,000+ |

Impact Of Experience And Education On Earnings

Experience and education significantly affect earnings in the finance industry. Here’s how:

- Entry-Level: Graduates start with a foundational salary.

- Mid-Career: With some years under their belt, salaries grow as expertise develops.

- Advanced Degrees: Certifications like CFA and postgraduate degrees often lead to a salary boost.

For example, an MBA can propel a financial analyst to senior roles, increasing their earnings potential dramatically. A blend of practical experience coupled with continuous learning presents finance professionals with numerous opportunities to climb the earnings ladder.

Interdisciplinary Benefits And Versatility

Choosing to major in finance opens a world of possibilities. Not only do you learn about money management. You also gain skills that fit into various industries. The value of a finance degree lies in its diversity. You can adapt the skills to different fields. This includes technology and international trade.

Combining Finance With Technology

Finance and technology, often called Fintech, are fast friends in today’s world. A finance degree equips you with the knowledge to excel in this area. You learn about data analysis and digital trends.

- Digital currency markets require a keen financial understanding.

- Financial software development can enhance business efficiency.

- Using big data in finance helps predict market trends.

The Interface Of Finance With International Trade

Finance majors can excel in the global marketplace. Cross-border transactions and currency exchange are vital topics. They need expert financial insight.

| Financial Knowledge | Global Trade Application |

|---|---|

| Understanding markets | Making strong trade decisions |

| Risk assessment | Managing international trade risks |

| Regulatory compliance | Navigating global financial laws |

A finance degree prepares you for challenges in international trade. You learn to understand different economies. This makes you valuable in a globalized world.

Credit: careercenter.bauer.uh.edu

Preparation For Future Financial Challenges

A major in Finance is your ticket to mastering the money world. It gets you ready for money tasks big and small.

Adapting To Global Economic Changes

Moving money across the world can be tricky. Countries have different money rules. A finance degree teaches you to understand these rules. You get good at figuring out where the money should go.

- Track global trends – Notice big money patterns around the world.

- Tackle currency issues – Learn the best ways to deal with different money types.

- Manage risk – Keep your money safe when the world’s money changes fast.

Innovative Problem-solving In A Dynamic World

Money problems can be puzzles. Your finance studies turn you into a great problem-solver.

| Finance Skill | Problem-Solving Benefit |

|---|---|

| Data analysis | Find money trends, make smart moves. |

| Investment strategies | Create plans to make more money. |

| Risk management | Protect your money from surprises. |

With this know-how, you face new money challenges with confidence. You make smart choices, fast.

Frequently Asked Questions Of Why Major In Finance

Why Do You Want To Major In Finance?

I want to major in finance to gain expertise in financial management, understand market dynamics, and build a solid foundation for a career in the economic sector. This field promises diverse job opportunities and the skills to make sound investment decisions.

Why Did You Choose Finance?

I chose finance for its critical role in business success and its dynamic nature, which presents constant learning opportunities and the ability to impact economic growth directly.

How Useful Is A Finance Major?

A finance major is highly versatile, offering numerous career paths in areas like investment banking, financial planning, and corporate finance. Acquiring financial acumen through this major can lead to lucrative job opportunities and essential skills for personal wealth management.

How Do I Know If I Want To Major In Finance?

Consider a finance major if you enjoy analyzing financial markets, managing money, and strategic planning. Strong math skills and interest in economic trends are good indicators of potential success in this field. Assess your passion for financial problem-solving to guide your decision.

What Are Finance Major Career Prospects?

A finance major typically leads to careers in banking, investment management, financial planning, corporate finance, and consulting, offering diverse and lucrative opportunities.

Conclusion

Considering a finance major sets the stage for a diverse array of career paths. It equips students with vital skills for managing finances in personal and professional realms. Our discussion underlines the robust foundation and competitive edge this major offers.

Graduates emerge positioned for success in a dynamic economic landscape. Embrace finance for a future rich in possibility.