Specialty finance refers to financial services provided by non-bank institutions. These companies often focus on particular niches within the finance sector.

Specialty finance companies offer consumers and businesses loan products and financial services that are not typically provided by traditional banks. This sector encompasses a diverse range of services, including but not limited to, equipment leasing, asset-backed lending, consumer finance, and commercial real estate loans.

Such companies often cater to the unique needs of small to medium-sized businesses or individuals with specific financial requirements. By specializing, these firms can offer expertise and tailored solutions that larger, more generalized banks might not. Entities in this space are known for their willingness to take on risks that do not meet the stringent criteria of conventional lenders, thus fulfilling the demands of underserved markets. They play a crucial role in providing access to capital for niche markets and contributing to financial inclusivity.

The Essence Of Specialty Finance

Specialty finance lives at the crossroads of unique financing needs and tailored financial solutions. Serving a niche often overlooked by traditional banks, specialty finance equips businesses and consumers with the monetary tools they need. From lending to investments, this concierge-level financial approach addresses specific requirements with precision and expertise.

Core Components And Services

Leading the charge in specialty finance are bespoke services and components. Clients expect and receive a suite of tailor-made solutions to fit their financial puzzle.

- Customized Lending Solutions: Loans shaped to the size and scope of the project.

- Dedicated Advisory Services: Expert guidance for informed decision-making.

- Asset-based Financing: Capital anchored in the strength of assets.

- Structured Finance Products: Innovative constructs like CLOs and MBSs.

- Leasing and Equipment Finance: Flexibility for business operational needs.

Specialty Vs. Traditional Financing

Specialty finance distinguishes itself from traditional financing with its non-cookie-cutter approach.

| Specialty Finance | Traditional Financing |

|---|---|

| Personalized solutions | Generic products and services |

| Flexible terms and structures | Rigid conditions and criteria |

| Asset-based opportunities | Primarily credit-based offerings |

| For niche markets and needs | Mass-market orientation |

| Complex financial instruments | Standardized loans and lines of credit |

Credit: mercercapital.com

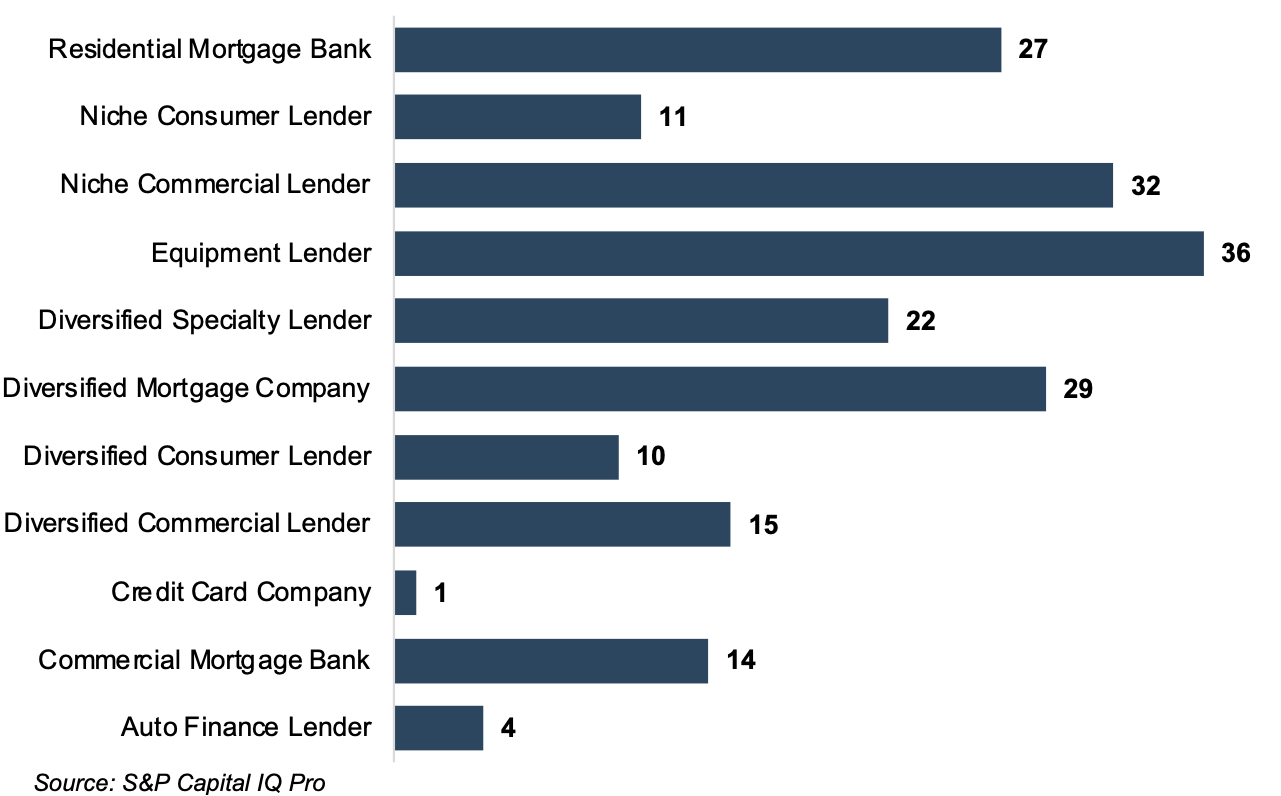

Sectors Within Specialty Finance

Specialty finance is a term that describes a variety of financial services designed to meet the unique needs of specific consumer and commercial market segments. These services often cater to areas underserved by traditional banks. Within this broad category, numerous sectors exemplify the diversity of financing solutions available.

Consumer Lending Niches

The consumer lending segment of specialty finance offers loans tailored to individuals. These include personal loans, auto financing, and educational loans. Creative options often emerge to serve customers with specialized needs. For example:

- Peer-to-peer lending connects borrowers directly with investors.

- Payday and installment loans help cover short-term cash needs.

- Subprime lending supports those with less-than-perfect credit scores.

Commercial Financing Subsectors

On the commercial side, specialty finance includes areas such as:

| Type | Description |

|---|---|

| Equipment Leasing | Financing for business equipment use without ownership. |

| Factoring Services | Companies sell accounts receivable for immediate cash. |

| Merchant Cash Advances | Businesses get upfront cash in exchange for a portion of future sales. |

These services allow businesses to access the tools they need for growth and to better manage their cash flow.

Growth Drivers

Specialty finance is an ever-evolving field. This means it grows often. The main things that help it grow are new tech and more customers. Let’s have a look at these growth drivers in detail.

Innovations In Financial Technology

Innovations in financial technology, or fintech, push specialty finance growth. New apps and tools make money matters easy, fast, and safe.

- Mobile banking advancements let people bank from anywhere.

- Blockchain tech makes loans and money transfers very secure.

- AI and machine learning help companies understand what customers need.

Demand In Underserved Markets

Underserved markets also fuel growth. Many people and businesses can’t get traditional bank services. Specialty finance fills this gap.

| Reason | Detail |

|---|---|

| Flexible options | Lenders give loans that banks may not. They offer custom options. |

| Easy to use | Services are simple to understand and use. No complex bank rules. |

| Fast help | People get money faster than regular banks provide. |

Credit: www.oppenheimer.com

Risks And Challenges

Entering the world of specialty finance brings unique opportunities. It also carries its own set of risks and challenges. Understanding these hurdles helps businesses navigate a complex landscape. Knowing the pitfall areas makes for better planning and strategy. Let’s dig into two critical ones:

Regulatory Hurdles

Specialty finance companies face strict regulations. Rules change often. Businesses must adapt quickly. Non-compliance can lead to fines or worse. Staying updated with laws keeps a company safe. Here are key regulatory hurdles:

- Licensing requirements vary by state and service.

- Consumer protection laws impact product offerings.

- Data protection regulations mandate robust systems.

Partnering with legal experts can help navigate these complexities. Companies need to invest in compliance to thrive long-term.

Economic Sensitivity

Specialty finance is sensitive to economic changes. Interest rate shifts impact borrowing costs. This can affect profit margins. Economic downturns can lead to higher default rates. Here’s a glimpse of the economic sensitivity:

| Economic Factor | Impact on Specialty Finance |

|---|---|

| Rising Interest Rates | Increased cost of capital |

| Economic Downturn | Higher default rates |

| Strong Economy | Greater demand for loans |

Diversifying products can mitigate these risks. Building a reserve fund helps too. Good customer credit analysis is crucial. These practices protect against unexpected economic shifts.

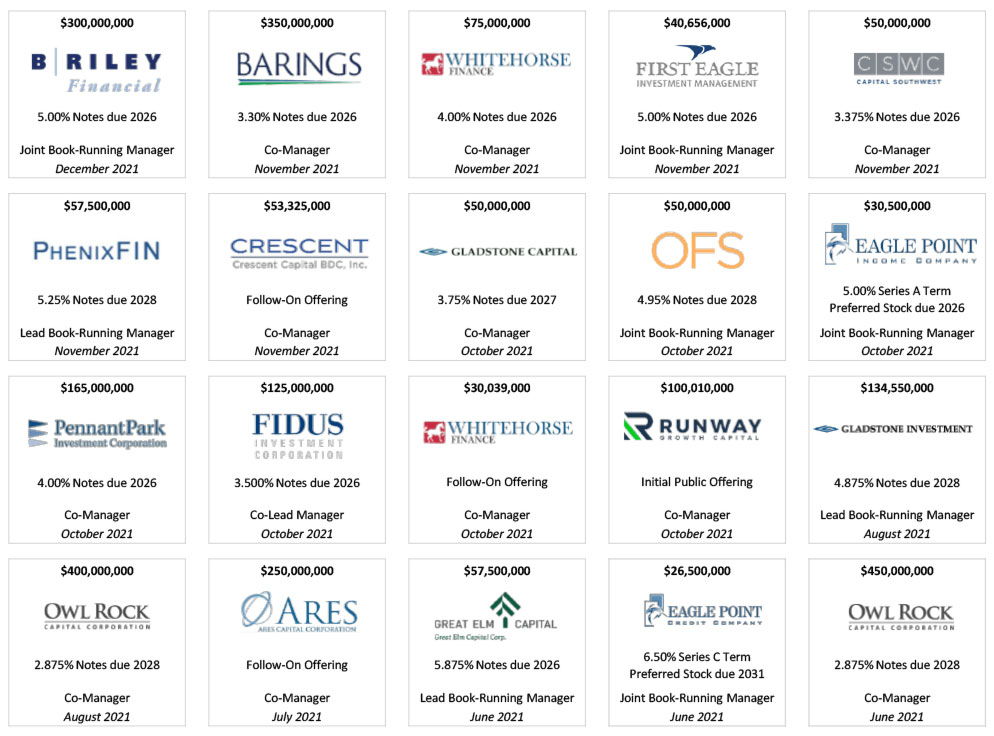

Investing In Specialty Finance

Are you ready to dive into the dynamic world of specialty finance investing? This niche market opens doors to a variety of financial services, separate from traditional banking. It provides unique opportunities for investors seeking to enhance their portfolio.

Evaluating Specialty Finance Companies

In-depth research is critical before investing in specialty finance firms. Key factors to scrutinize include:

- Management Quality: Look for experienced leaders with proven track records.

- Financial Health: Examine balance sheets, income statements, and cash flow.

- Regulatory Compliance: Ensure the company meets all regulatory requirements.

- Market Position: Assess the firm’s competitive edge and market share.

- Risk Management: Understand how the company mitigates loan and market risks.

Check customer reviews and industry reports for additional insights.

Potential Returns And Diversification

Specialty finance can be a lucrative investment:

- It may offer higher yields compared to traditional investments.

- Diversification benefits arise from its low correlation with standard assets.

- Investors can potentially gain from various subsectors, like leasing, lending, or asset financing.

- Portfolio diversification can reduce overall risk.

Risk tolerance and investment horizon dictate suitable specialty finance opportunities.

Credit: www.finleycms.com

Future Trajectory

The landscape of specialty finance is on a rapid evolutionary path. Key developments in technology and changing market dynamics continue to shape its promising future. Businesses and investors alike keep a keen eye on the emerging trends that dictate the new direction of specialty finance services.

Impact Of Digital Transformation

- Digital platforms revolutionize customer interactions.

- AI and ML optimize risk assessment and decision-making.

- Blockchain enhances security and transparency in transactions.

- Automation of processes cuts costs and increases efficiency.

As digital technology advances, it injects efficiency, accuracy, and accessibility into specialty finance. The traditional models are being disrupted, propelling the industry towards a tech-driven future where convenience and customization are at the forefront.

Predictions For Specialty Finance

| Year | Prediction |

|---|---|

| 2023 | Consolidation of services becomes more common. |

| 2024 | Mobile-first approaches dominate customer outreach. |

| 2025 | Green financing products gain traction. |

Further integration of innovative financial products tailored to niche markets is expected. With an emphasis on sustainability and social impact, specialty finance is poised to expand its scope, making it more inclusive and diverse.

Frequently Asked Questions On What Is Specialty Finance

What Is A Specialist Finance?

A specialist finance expert focuses on niche financial services, offering tailored advice on complex investment strategies and corporate finance solutions. They possess deep knowledge in a specific financial area, aiding clients with specialized needs.

What Is The Difference Between Direct Lending And Specialty Finance?

Direct lending offers loans directly to borrowers without intermediary banks, whereas specialty finance focuses on specific sectors or financing situations, often accommodating unique or riskier requirements.

Is Specialty Finance Private Credit?

Specialty finance is a sector within private credit, focusing on niche lending markets typically underserved by traditional banks.

What Is Consumer And Specialty Finance?

Consumer and specialty finance refers to financial services tailored to individual consumers and niche markets. It encompasses personal loans, credit cards, and targeted lending for specific purchases.

What Is Specialty Finance?

Specialty finance refers to financial services provided by institutions focusing on niche markets or non-traditional lending and investment products, often tailored to meet specific needs of clients.

Conclusion

Understanding specialty finance is crucial for navigating modern financial landscapes. It offers tailored solutions to unique monetary needs. By exploring this nuanced sector, individuals and businesses can leverage unconventional funding opportunities. Remember, embracing specialty finance could be the key to your next successful financial strategy.

Embrace the possibilities and transform challenges into triumphs.