The finance career pathway that includes assisting individuals with budget management and tax calculations is personal financial advising. Personal financial advisors guide clients on finances, taxes, and investments.

Navigating through the complexities of finance requires expertise, a role personal financial advisors excel in. They empower clients to plan for short-term and long-term financial goals, from saving for a child’s education to preparing for retirement. These professionals tailor their advice to the unique financial situation of each client, ensuring individuals can confidently manage their budgets and understand taxation.

Their work often involves creating customized plans that highlight savings opportunities, investment strategies, and tax planning to optimize a client’s financial potential. With an understanding of the latest laws and financial products, personal financial advisors are crucial in helping people make informed financial decisions. Ideal for those with strong analytical skills and a passion for finance, this career path blends technical knowledge with interpersonal skills to assist clients in achieving financial stability and growth.

Exploring Careers In Financial Planning

Imagine a career where you empower others to achieve financial well-being. The financial planning field offers just that. Financial planning is about creating a roadmap for individuals to manage their income, expenses, and investments. It’s a pathway where you can guide people toward their dreams by helping them plan their financial future.

The Role Of A Financial Planner

What does a financial planner do? They wear many hats – advisor, guide, and strategist. A financial planner assists with budget creation and management. They also ensure that clients make informed decisions about their finances, which includes investment choices and tax calculations. Their main goal is to align financial strategies with personal goals. Financial planners make a difference in people’s lives.

Education And Certification Requirements

To become a financial planner, a specific education path is vital. This usually involves a degree in finance, economics, or a related field. Post-degree, certifications like the Certified Financial Planner (CFP) credential are essential. Here’s a quick rundown of the steps:

- Earn a Bachelor’s Degree.

- Complete a CFP Board-Registered Education Program.

- Pass the CFP Certification Examination.

- Gain the Required Experience.

- Maintain Certification through Continuing Education.

Gaining these qualifications ensures that a financial planner is competent and ethical in their practice.

Credit: handbook.gitlab.com

Personal Finance Advisors At A Glance

Personal finance advisors stand as financial guardians for many. They guide individuals through the maze of financial decisions. This includes creating and managing budgets, and calculating taxes. Expertise and personalised advice shape the path to financial stability for their clients.

Services Offered By Personal Finance Advisors

- Budget Planning: Crafting personalized spending plans.

- Tax Preparation: Calculating and filing taxes efficiently.

- Investment Strategies: Advice on where to invest for growth.

- Retirement Planning: Long-term financial security tactics.

- Insurance Planning: Choosing the right protection for assets.

- Debt Management: Techniques to reduce and eliminate debt.

Working With Individual Clients

Personal finance advisors tailor unique financial strategies for each person. They listen closely to goals and worries. After, they create a clear financial plan. Advisors support clients in every financial milestone, big or small. They work one-on-one to improve financial health and knowledge.

The Intersection Of Finance And Daily Life

Imagine living a life where money works for you, not against you. That’s what finance professionals aim to achieve as they guide individuals through the maze of managing money. They become the architects of financial stability, building strong foundations through budget planning and tax calculations. This pathway is not just about crunching numbers; it’s about unlocking the secrets of financial freedom for everyone.

Budget Planning Essentials

Masterful budget planning leads to financial peace of mind.

Here’s how finance professionals can help:

- Analyze spending habits

- Set realistic goals for saving and spending

- Create a tailored budget plan

- Implement tools to track progress

- Adjust plans as life changes

Skilled advisors turn complex ideas into simple steps.

Demystifying Tax Calculations For Clients

Taxes can confuse and overwhelm.

Finance experts simplify tax talk:

- Explain tax laws in plain language

- Identify potential deductions and credits

- Calculate taxes accurately

- Plan throughout the year for tax efficiency

These professionals ensure clients never overpay and always comply with tax rules.

Tax Professionals And Their Impact

Tax professionals play a critical role in finance, guiding individuals and businesses through the complexities of managing budgets and calculating taxes. These experts have the knowledge and experience to make a substantial impact on their clients’ financial health, ensuring compliance while maximizing savings.

Navigating Through Tax Laws

Strategies For Effective Tax Planning

Effective tax planning is more than just a once-a-year activity. Experienced tax advisors work with clients year-round to tailor strategies that fit their unique financial situations. Clients can anticipate and avoid common financial snags.

| Tax Planning Strategy | Benefit |

|---|---|

| Retirement Contributions | Lower taxable income |

| Education Savings Plans | Tax-free growth potential |

| Health Savings Accounts | Tax deductions and savings for medical expenses |

- Analyzing past returns for future tax reductions

- Identifying deductions and credits to increase savings

- Adjusting withholding to improve cash flow

Budget Analysts: Unsung Heroes In Financial Management

Pondering a career in finance that revolves around aiding individuals with their budgeting and tax calculations?

Budget Analysts represent just that – they guide people through the maze of numbers. These experts wear capes made of spreadsheets and calculators. They are pivotal in crafting and fine-tuning financial plans.

Budget analysts bring order to the financial chaos. Their role makes them akin to architects in the financial realm.

- Analyze spending – They search for ways to make budgets lean and functional.

- Forecast finances – Predicting future expenses is their forte.

- Ensure accuracy – Every digit must be perfect, leaving no room for errors.

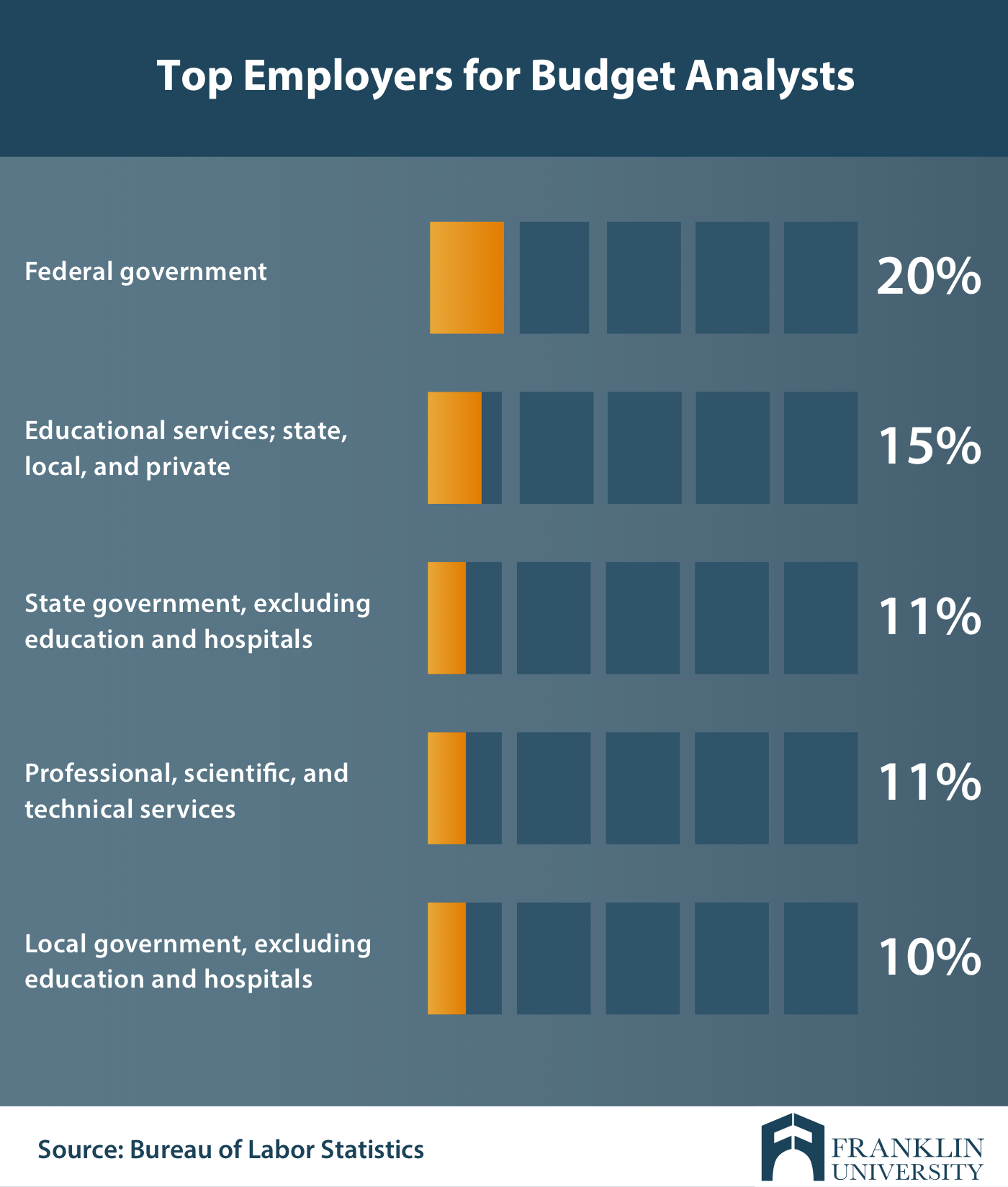

Budget analysts work in various settings. This includes government agencies, universities, and corporations. Their primary mission is creating budgets that work.

But it’s more than just number crunching. Budget analysts also partner closely with clients.

- They listen closely to understand financial goals.

- They work together to create a tailored budget plan.

- They teach clients how to stay within their financial means.

It’s a collaborative effort. The goal is to ensure clients can navigate financially tight turns.

Budget analysts use their skills to prepare people for tax seasons as well. They compute taxes, find deductions, and give valuable tax-saving tips.

Ready to embark on a finance career as a budget analyst? You’ll be a frontline warrior in the battle for financial stability and success. Budget analysts help write the financial future for countless people and organizations. Now that’s a hero’s journey worth embarking on!

Credit: www.rasmussen.edu

Transformative Tools And Software In Finance

A finance career that involves helping individuals with budgeting and tax calculations is both challenging and rewarding. Modern finance professionals rely heavily on software to provide the best service. These digital tools have completely transformed the way finance careers are navigated.

Technological Assistance in Budgeting and TaxationTechnological Assistance In Budgeting And Taxation

Advanced software makes budgeting and taxation seamless. Budgeting apps sync with user accounts to track spending. Tax software automates complex calculations. This tech minimizes errors and saves time, guiding finance professionals to deliver better services.

- Automated expense tracking for a clear financial picture

- Real-time data for informed decision-making

- Secure platforms ensure client data protection

Training Individuals On Financial Management Tools

Empowering clients through education is key. Finance careers involve instructing clients on tool usage. This training helps them manage their finances independently. Professionals who can effectively teach these skills are valuable in the finance industry.

| Tool | Purpose | Impact on Client |

|---|---|---|

| Budgeting Apps | Monitor spending | Increase savings |

| Tax Software | Simplify filing | Reduce stress |

| Investment Simulators | Teach trading | Grow confidence |

Credit: www.franklin.edu

Frequently Asked Questions For Which Finance Career Pathway Includes Helping People Create And Manage Budgets And Calculate Taxes?

Which Finance Career Pathway Includes Helping People Create And Manage Budgets And Calculate?

The finance career pathway of personal financial advising involves assisting individuals with budget creation and management.

Which Finance Career Pathway Includes Helping People Create And Manage Budgets And Calculate Taxes Brainly?

The Personal Financial Planning career pathway focuses on helping individuals manage budgets and calculate taxes.

Which Careers Are A Part Of The Finance Career Cluster?

Careers within the finance career cluster include financial analysts, accountants, auditors, bankers, and investment brokers. Other roles comprise financial planners, insurance agents, and risk managers.

What Is The Finance Career Field?

The finance career field encompasses jobs focused on managing money, including roles in banking, investment, insurance, and corporate finance. Careers range from financial planning to trading and risk management.

What Careers Specialize In Budget Management?

Personal financial advisors and budget analysts are two common professions focused on assisting individuals and organizations with budget management.

Conclusion

Selecting a career in finance that focuses on personal financial planning secures a future in aiding individuals with budgeting and tax planning. This path not only ensures professional growth but also the satisfaction of helping others manage their financial health.

Empowerment through financial education becomes a shared success as you guide and support clients towards monetary balance and security.