The Second Foundation is not a concept used in finance. It is often confused with the Second Foundation from Isaac Asimov’s science fiction series.

Understanding financial concepts and institutions often involves navigating through a myriad of terms and theories. One might stumble upon references like the “Second Foundation,” but in the context of finance, this term does not have a recognized meaning. The clarification is crucial because the Second Foundation is actually borrowed from the realm of science fiction, specifically from Isaac Asimov’s celebrated Foundation series.

It is essential to distinguish between literary references and actual financial jargon to maintain clarity. Finance itself encompasses a wide range of topics, from investment strategy and economic theory to the nuts and bolts of financial planning and analysis. Engaging with these concepts requires precise language and terminology that are uniformly accepted within the financial industry. Thus, while the Second Foundation is an intriguing fictional entity, it holds no bearing on financial discourse or practice.

Credit: www.shoeboxed.com

The Essence Of Second Foundation In Finance

The Second Foundation in finance is not a term commonly heard every day. It emerges from the convergence of strategic financial planning and strong financial analytics. It provides a framework to support long-term financial health and agility. Discover the nuts and bolts of this concept through its origins and core principles.

Origins And Conceptual Background

The term “Second Foundation” originally comes from science fiction. Its adaptation in finance borrows from the idea of a hidden, guiding force behind robust financial structures. This foundation is not physical but conceptual, founded on systematic analysis and forward-thinking strategies.

- Draws inspiration from predictive sciences.

- Focuses on intelligence and foresight in finance.

- Stresses the importance of financial stabilization mechanisms.

Core Principles And Goals

The core of the Second Foundation in finance lies in its principles and objectives. It aims to safeguard financial stability and ensure sustainable growth. Here are its central tenets and what it aspires to achieve:

- Risk Management: Identifying risks before they become threats.

- Data Analysis: Leveraging data for informed decisions.

- Strategic Planning: Establishing long-term financial plans.

- Adaptability: Staying flexible to meet future challenges.

By embracing these principles, organizations aim to build a resilient financial foundation capable of withstanding volatility and uncertainty.

Comparative Analysis With Traditional Financial Institutions

Exploring how the Second Foundation in finance compares to traditional financial institutions reveals vital insights for both investors and market dynamics. This section outlines core similarities and differences. It also delves into the impact on investors and markets.

Similarities

- Both adhere to financial regulations

- Both aim to maximize wealth for investors

- Offer a range of financial services and products

Differences

| Second Foundation | Traditional Institutions |

|---|---|

| Typically more tech-driven | Often rely on legacy systems |

| May use alternative data in decision-making | Focus on historical data |

| Oriented towards innovation | May resist change due to established practices |

Impact On Investors And Markets

Investors benefit from advanced tools for risk assessment and investment choices. Markets experience increased efficiency and liquidity. The Second Foundation can introduce novel financial products that traditional bodies might not offer.

The Role Of Second Foundation In Financial Stability

The Role of Second Foundation in Financial Stability centers around creating a robust financial system. Protection against potential financial crises is a primary goal.

Mitigating Risks And Uncertainties

The Second Foundation aims to shield the economy from shocks. This is key in maintaining the overall health of financial markets. To achieve stability, the foundation:

- Monitors financial systems regularly to catch early signs of distress.

- Develops tools for risk assessment to evaluate threats to the system.

- Enacts contingency plans designed to handle unexpected events.

Enhancing Market Integrity

Market integrity signifies trust in financial systems. The Second Foundation plays a role in establishing this trust by:

- Setting regulations that combat fraud and corruption.

- Promoting transparency in financial transactions to foster investor confidence.

- Ensuring fair practices are upheld across all financial institutions.

Credit: thefivefoundations.weebly.com

Success Stories And Notable Interventions

Discover how the ‘Second Foundation’ has shaped the finance world. Read on for real-life success stories and powerful interventions.

Case Studies Of Second Foundation Initiatives

Efficient markets reflect well-informed decisions. The Second Foundation leverages this with impactful programs. These initiatives help bolster financial literacy and market stability. Let’s delve into specific case studies that illuminate their work.

- Microfinance Support: By backing microfinance institutions, the Second Foundation enabled small business growth, directly boosting developing economies.

- Fintech Innovations: Their investment in fintech startups has streamlined banking, making financial services accessible to the underbanked populations.

- Crisis Management Funds: During financial downturns, they provided stability by setting up emergency funds that helped institutions avoid collapse.

Long-term Benefits To The Financial Ecosystem

The Second Foundation’s strategies yield lasting financial benefits. Their work fosters resilience and inclusivity in the financial ecosystem.

| Intervention | Impact |

|---|---|

| Educational Programs | Generations of savvy consumers and investors emerge, supporting economic growth. |

| Regulatory Reforms | Market fairness and investor confidence improve, leading to stable capital flows. |

| Community Investments | Long-term viability of small businesses is secured, creating local jobs and wealth. |

Challenges Faced By The Second Foundation

The concept of the Second Foundation in finance is steeped in complex theory and application. This institution’s role touches on advanced economic and psychohistorical principles. Its mission revolves around guiding and stabilizing the financial galaxy. Yet, numerous hurdles stand in its path.

Common Criticisms And Rebuttals

Critics frequently question the Second Foundation’s efficacy and transparency. They raise issues about its behind-the-scenes influence on market dynamics. Here, we’ll confront some of these challenging criticisms directly.

- “The Second Foundation lacks accountability.”: In response, reports highlight stringent internal audit measures. These ensure every decision undergoes rigorous scrutiny.

- “Its operations are too secretive.”: The foundation counters that discreet actions prevent market panic, aiding smooth financial flow.

- “It unfairly manipulates economies.”: However, foundation representatives affirm their interventions are solely for long-term financial stability.

Navigating Regulatory And Ethical Concerns

The Second Foundation operates in a space where regulation and ethics are paramount. Reconciling its goal of economic stability with legal frameworks is ongoing. Proponents assert that it upholds the highest ethical standards.

| Area of Concern | Foundation’s Approach |

|---|---|

| Regulatory Compliance | Adheres to all applicable laws and updates protocols accordingly. |

| Transparency | Periodic disclosures balance the need for secrecy with public interest. |

| Ethical Mandate | Emphasizes ethical decision-making in all operations. |

Foundations must align their secret work with society’s norms and laws. Their advanced foresight must respect individual and collective rights. Success rests on the nuanced balance between guiding and overpowering economic trends.

Credit: www.freedomfoundation.com

Future Prospects And Evolution

The Second Foundation in finance stands on the cusp of transformative changes. Across the industry, experts anticipate advances that will reshape financial paradigms. These changes promise more responsive, inclusive, and sustainable financial systems. Global trends and innovative reforms are set to alter the landscape profoundly. Such evolution in finance will touch every aspect of economies worldwide.

Adapting To Global Financial Trends

Adapting effectively to global financial trends is crucial. It secures long-term viability and competitiveness. Emerging markets influence investment strategies. Technological advancements drive operational efficiencies. Here are key trends poised to impact the Second Foundation:

- Digital currencies may redefine monetary policies.

- Blockchain technology is set to enhance transparency.

- Sustainable investing becomes a staple, not an option.

Potential Reforms And Innovations

Potential reforms and innovations ensure the Second Foundation remains relevant. They also make it an instrument of economic stability and growth. Here’s a snapshot of what’s on the horizon:

| Area | Innovations | Impact |

|---|---|---|

| Regulation | Smarter, data-driven policies | Increases system resilience |

| Technology | AI and machine learning | Improves decision-making |

| Accessibility | Mobile-first services | Expands financial inclusion |

As the Second Foundation in finance embraces these shifts, it will likely emerge stronger. It will be more attuned to the needs of a diverse, global customer base. Anticipation and preparedness are the keys to leveraging these exciting developments.

Frequently Asked Questions On What Is The Second Foundation In Finance

What Is The 2nd Foundation In Finance?

The second foundation in finance is understanding and managing risks. It involves evaluating potential threats to investment returns and creating strategies to mitigate them.

What Are The 5 Foundations Of Finance?

The five foundations of finance include budgeting, saving, investing, borrowing, and risk management. These principles guide financial decision-making and stability.

What Is The 3rd Foundation In Personal Finance?

The third foundation in personal finance is creating an emergency fund to cover unexpected expenses.

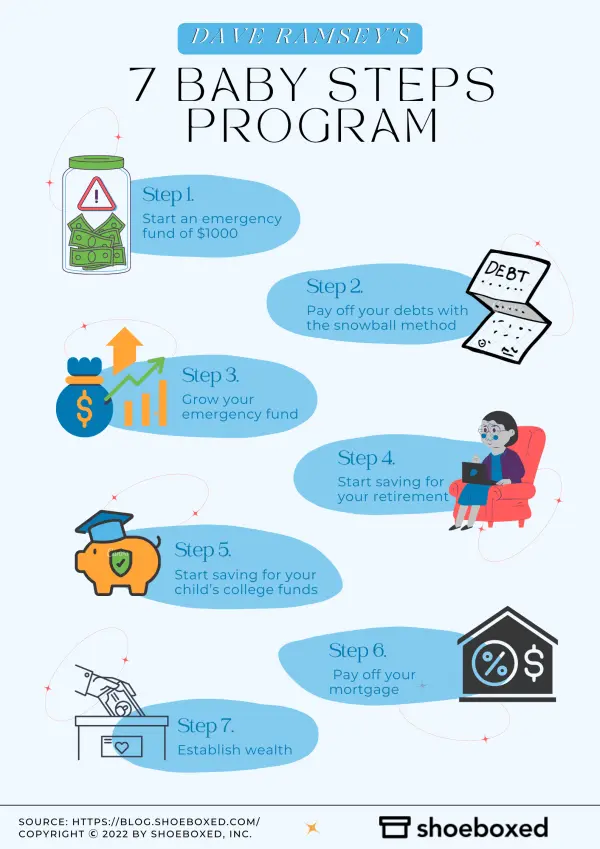

What Is The Second Foundation In Ramsey Classroom?

The second foundation in Ramsey Classroom is to pay off all debt using the debt snowball method.

What Is Second Foundation In Finance?

Second Foundation refers to an advanced, theoretical concept in finance involving strategies to stabilize a financial system or market, often through regulatory frameworks or market interventions.

Conclusion

Understanding the Second Foundation in finance offers a strategic edge. It simplifies complex investment theories and strategies. Embrace its principles to navigate market challenges successfully. As financial landscapes evolve, the Second Foundation remains a pivotal guide. Keep it at the core of your fiscal planning.