The Second Foundation in personal finance is establishing an emergency fund. This fund acts as a financial safety net for unforeseen expenses.

Building a solid financial plan begins with ensuring you have security for unexpected events, such as job loss or medical emergencies. Crafting an emergency fund should be a top priority, right after mastering budgeting—often considered the first foundation. Start by saving enough to cover at least three to six months of living expenses.

This practice reduces the need for high-interest debt during tough times, maintaining your financial stability. Prioritizing this step demonstrates a commitment to a proactive rather than reactive approach to one’s financial health, setting the stage for continued wealth building and risk management.

The Concept Of The Second Foundation In Personal Finance

Imagine building a financial house with two strong supporting layers. The first is traditional planning, like budgeting and saving. The second, less known but vital, is the Second Foundation in Personal Finance. It’s the safety net that keeps your finances resilient against unexpected storms in life.

Origins Of The Second Foundation

The idea of a Second Foundation in personal finance isn’t from a book or a financial guru. It comes from the understanding that money needs a backup plan. The term ‘Second Foundation’ hints at an additional layer of financial security to support the traditional methods.

Second Foundation Vs. Traditional Financial Planning

While traditional financial planning focuses on income, saving, and investing, the Second Foundation emphasizes protection and adaptability. It’s about creating a plan B before you need it.

- Emergency funds: Money set aside for unexpected costs.

- Insurance: Policies to safeguard against financial disasters.

- Diversification: Spreading investments to minimize risks.

- Debt management: Keeping loans under control to prevent crisis.

Understanding this foundation empowers you to build a financial fortress that can withstand any challenge.

Credit: thefivefoundations.weebly.com

Building Your Financial Second Foundation

Are you ready to build a strong financial future? Imagine your finance as a house. The Second Foundation is the robust support your money needs. Let’s learn how to create a sturdy financial plan that stays solid in all seasons.

H3 Heading: Assessing Financial HealthAssessing Financial Health

Check your financial pulse. Just like a doctor’s check-up, assessing where you stand financially is crucial. Start with knowing your net worth and understanding your cash flow. A healthy financial state has more money coming in than going out. List all your assets and debts. This will give you a clear financial snapshot.

List for Asset and Debt Tracking- Monthly Income

- Monthly Expenses

- Total Savings

- Credit Card Debt

- Student Loans

- Mortgage Details

Essential Components Of A Robust Plan

Every sturdy house needs quality materials. The same goes for your financial plan. Here are the key parts:

Table of Essential Components| Component | Details | Goals |

|---|---|---|

| Budget | Track spending | Reduce waste |

| Emergency Fund | Cover 3-6 months | Prevent debt |

| Investment | Grow wealth | Secure future |

| Insurance | Protect assets | Minimize risk |

| Retirement Plan | Build savings | Enjoy later |

Transform your budget into a power tool for saving. Start an emergency fund for rainy days. Invest wisely to grow your wealth. Get insurance to shield your assets. Think ahead with a retirement plan. Each part of your plan should have clear, achievable goals.

Key Strategies For Strengthening The Second Foundation

Beginning of the Blog Post SectionStrengthening the Second Foundation in personal finance means building a stable and resilient financial status. The ‘Second Foundation’ refers to the steps beyond basic budgeting. It includes creating diverse investments and an emergency fund. These strategies help withstand financial storms. Let’s explore key methods to fortify this part of your financial plan.

Diverse Investment PortfoliosDiverse Investment Portfolios

Investing across different areas reduces risk. Imagine not putting all your eggs in one basket. This diversity helps protect your money from market ups and downs.

- Stocks offer potential growth over time.

- Bonds can provide steady income with less risk than stocks.

- Real estate and commodities like gold diversify further.

Remember, a mix of investments suits different goals and timelines. A financial advisor can tailor this mix for you.

Emergency Fund ImportanceEmergency Fund Importance

An emergency fund is money set aside for unexpected costs. It is a financial safety net. This fund helps pay for things like medical bills or car repairs without touching investments.

- Start small, even if it’s just a little from each paycheck.

- Aim for saving three to six months of living expenses.

- Keep the fund in a savings account or somewhere easily accessible.

Building this fund takes time but gives peace of mind. It means you’re ready for life’s surprises.

Credit: www.shoeboxed.com

Overcoming Challenges To Building The Second Foundation

Building the Second Foundation in personal finance means creating a stable financial future. But reaching that goal is not always a clear path. Challenges like debt and economic twists make the journey tough. Knowing how to manage these can set you on the right track.

Managing Debt Effectively

Debt can slow down your financial progress. It’s like heavy weights on your shoulders. To lift these weights, follow these steps:

- List all debts: Start by knowing what you owe.

- Prioritize payments: Pay high-interest debts first.

- Create a budget: Stick to a spending plan.

- Seek advice: Talk to a financial expert if needed.

Moving forward, avoid taking on more debt than you can handle.

Navigating Economic Uncertainty

The economy can be unpredictable. Your financial plan should be flexible. Here are tips to stay afloat during tough times:

- Build an emergency fund: Save money for the unexpected.

- Invest wisely: Don’t put all your eggs in one basket.

- Stay informed: Watch economic trends closely.

- Adapt your budget: Cut back on non-essential spending.

Staying prepared lets you tackle economic ups and downs with confidence.

Case Studies: Success Stories Of Second Foundation

In the realm of personal finance, mastery over the Second Foundation, which includes building a sizeable emergency fund, robust insurance, and smart debt management, can mark the difference between thriving and surviving. Real-world examples offer valuable insight into the potent impact of a well-laid financial foundation. Here, we explore stories of individuals who constructed their Second Foundation with precision and glean insights from those whose financial blueprints did not hold up.

Real-life Outcomes From Effective Second Foundation Strategies

- Emergency Funds: Jenna, a graphic designer, stashed away six months’ income and dodged financial ruin after sudden job loss.

- Insurance: Mike’s strategic health coverage shielded him from devastating bills following an unexpected surgery.

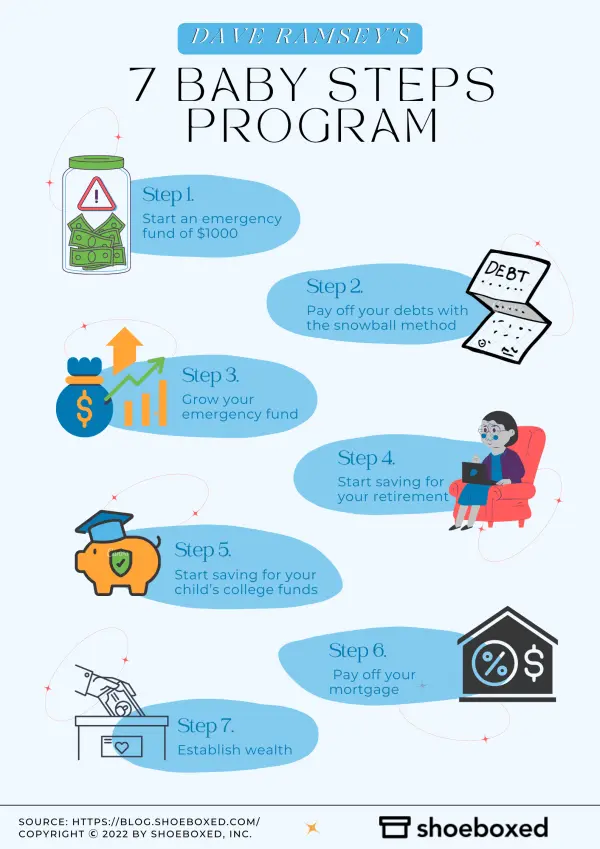

- Debt Management: The Andersons tackled credit card debt with a snowball method, liberating their budget and boosting credit scores.

| Name | Strategy | Outcome |

|---|---|---|

| Jenna | 6-month Emergency Fund | Financial security during job hunt |

| Mike | Comprehensive Health Insurance | Covered surgery costs |

| The Andersons | Debt Snowball Method | Eliminated debt, improved credit |

Lessons Learned From Failed Approaches

- Lack of Savings: Sara’s neglect to save led to spiraling debt when her car broke down.

- Inadequate Insurance: Bob faced financial hardship due to minimum car insurance after an accident.

- High-Interest Debts: Emma’s payday loans snowballed, proving costlier than she anticipated.

- Start an emergency fund early. Avoid Sara’s mistake.

- Choose the right insurance. Don’t settle for less like Bob.

- Understand debt terms. Don’t get trapped as Emma did.

Credit: www.pinterest.com.au

Future-proofing Your Finances

Strong finances stand like a fortress in the face of life’s uncertainties. Future-proofing your finances means preparing for everything.

Adapting To Changing Financial Landscapes

The financial world never stands still. Economies shift and markets change.

- Stay informed about economic trends.

- Review your budget with each major life event.

- Build an emergency fund for unexpected expenses.

- Diversify investments to spread risk.

Continuous Learning And Financial Education

Knowledge is the tool that carves a path to financial stability. Embrace learning to keep your finances strong.

- Read books, blogs, and articles on finance.

- Enroll in online courses for deeper insights.

- Attend workshops led by finance experts.

- Update your skills for career growth.

Frequently Asked Questions Of What Is The Second Foundation In Personal Finance

What Are The 5 Foundations Of Finance?

The five foundations of finance are budgeting, saving, investing, borrowing responsibly, and understanding the risks involved.

What Is The Second Foundation Quizlet?

The Second Foundation Quizlet is a study tool offering flashcards and learning activities related to Isaac Asimov’s “Second Foundation” novel.

What Is The 3rd Foundation In Personal Finance?

The third foundation of personal finance is maintaining an emergency fund. This reserve covers unexpected expenses, providing financial security.

What Is The First Foundation Of Personal Finance?

The first foundation of personal finance is understanding and managing your budget. This involves tracking income, controlling expenses, and setting financial goals.

What Is The Second Foundation?

The Second Foundation in personal finance refers to a strategy focused on safeguarding and growing wealth through informed financial management and investment.

Conclusion

Understanding the Second Foundation in personal finance arms you with critical knowledge for fiscal stability. It’s about building and safeguarding wealth systematically. Remember, it’s not just about saving; it’s a strategic approach to ensure long-term financial security. Start reinforcing your financial bastion today—your future self will thank you.