Ear Finance is a DeFi (Decentralized Finance) protocol for lending and borrowing assets. It operates on blockchain technology to offer financial services without intermediaries.

Ear Finance provides users with a platform to access decentralized financial services, enabling them to lend out their cryptocurrencies to earn interest or borrow against their digital assets. This innovative approach to finance eliminates the need for traditional banking institutions, fostering a trustless ecosystem where transactions are transparent, secure, and fast.

The protocol leverages smart contract functionality, ensuring that all operations are algorithmically managed without the possibility of human error or manipulation. As the world of finance increasingly shifts towards blockchain-based solutions, Ear Finance positions itself as a key player in facilitating a more accessible and efficient financial landscape for users worldwide.

Credit: study.com

Decoding ‘ear Finance’: The Basics

Welcome to our deep dive into ‘Ear Finance’. This fresh concept intrigues many keen financial enthusiasts. Be ready to unravel the basics of Ear Finance!

Origins Of The Term

‘Ear Finance’ is a novel term. It captures the essence of auditory involvement in financial activities. This term hails from the innovative blend of technology and finance.

Fundamental Principles

Ear Finance stands on core principles. It emphasizes auditory engagement in financial decisions. Key principles include:

- Sensory-based learning

- Audio cues for market trends

- Verbal command transactions

The Ecosystem Of Ear Finance

Ear Finance is not just about hearing the clinks of coins anymore. It represents a complex system. This ecosystem includes various players and technology. Together, they create a symphony of economic activities. Let’s dive into this world and understand its elements.

Key Players And Stakeholders

In the Ear Finance ecosystem, multiple actors play crucial roles. Let’s meet these participants:

- Investors: They provide the fuel for growth.

- Developers: They build and maintain the infrastructure.

- Regulators: They ensure fair play in the financial arena.

- Users: They engage with services and products.

Technology And Platforms Involved

The technology behind Ear Finance is cutting-edge. It includes:

| Technology | Description |

|---|---|

| Blockchain | A secure and transparent way to record transactions. |

| Smart Contracts | Self-executing contracts with the terms directly into code. |

| Decentralized Applications (DApps) | Applications run on a P2P network rather than a single computer. |

These technologies support platforms like exchanges and wallets. They are vital to the ecosystem’s health.

How Ear Finance Transforms Traditional Models

Imagine a world where finance listens to you. That’s what Ear Finance does. It turns old money ideas upside down. Let’s dive into how Ear Finance shakes things up.

Impact On Conventional Banking

Ear Finance reimagines the bank we know. It merges technology and personal finance. It makes banks smarter and friendlier.

- 24/7 Access: No more waiting for banks to open.

- User Control: You’re the boss of your money.

- Reduced Fees: Say goodbye to high bank charges.

Advantages Over Standard Financial Systems

Next to conventional banking, Ear Finance stands tall. It’s not just different; it’s better. Here’s why:

| Standard Systems | Ear Finance |

|---|---|

| Limited Hours | Always Open |

| High Costs | Low to No Fees |

| Complex Products | Simple Options |

Credit: corporatefinanceinstitute.com

Ear Finance Real-world Applications

Ear Finance Real-World Applications have started transforming industries with their innovative models. This financial trend mixes traditional finance with digital platforms. It can provide more access and efficiency to users.

Case Studies: Success Stories

Success stories in Ear Finance showcase its potential:

- Peer-to-Peer Lending: An artist received funds directly from a fan. No banks needed.

- Streamlined Payments: A freelancer got paid instantly after project completion through a decentralized app.

- Efficient Charities: Donors saw exactly where funds went, ensuring transparency.

Sector-specific Implementations

Various sectors are reaping the benefits of Ear Finance:

| Sector | Application |

|---|---|

| Retail | Cryptocurrency payments lead to lower transaction fees. |

| Real Estate | Smart contracts simplify buying and selling processes. |

| Healthcare | Secure patient data sharing is possible through blockchain technology. |

Challenges And Risks In Ear Finance

Exploring the world of ‘Ear Finance’ uncovers unique opportunities. Yet, this innovative field is not without its obstacles. Understanding the challenges and risks is crucial for anyone involved in Ear Finance. It helps investors and developers navigate effectively.

Security Concerns

Security tops the list of worries in Ear Finance. Digital assets require robust protection. Hackers pose a real threat. Loss of funds can be devastating. Continuous vigilance and advanced security measures are non-negotiable.

Some security risks include:

- Smart contract vulnerabilities: Weaknesses can lead to breaches.

- Unauthorized access: Personal data breaches are of high concern.

- System failures: Technical issues can cause significant disruptions.

Regulatory Hurdles

Regulatory clarity is still evolving in Ear Finance. Different countries have different rules. Keeping up with regulations is a must for compliance. Failure to comply can lead to heavy penalties or operational shutdowns.

Challenges with regulation include:

| Regulatory Aspect | Challenge |

|---|---|

| Licensing Requirements | Securing proper licenses is often complex. |

| International Law | Global operations must navigate various legal frameworks. |

| Consumer Protection | New laws could require significant adjustments to operations. |

Credit: www.youtube.com

The Future Trajectory Of Ear Finance

Ear Finance is not just a concept; it’s evolving rapidly. As we look ahead, the future trajectory for this innovative financial stream seems bright.

The landscape of Ear Finance is ripe for transformative trends. How we interact with finance is on the cusp of a significant shift.

Emerging Trends

Staying ahead involves understanding emerging trends. Let’s explore what’s on the horizon.

- Integration of virtual reality in financial services

- Mobile-first approaches becoming the norm

- Personalized financial experiences through AI

Predictions For The Next Decade

The next decade for Ear Finance holds great potential. Here’s what to expect:

- User experience will drive financial service innovation.

- Decentralized finance may take center stage.

- There will be stricter data privacy regulations.

Frequently Asked Questions Of What Is Ear Finance

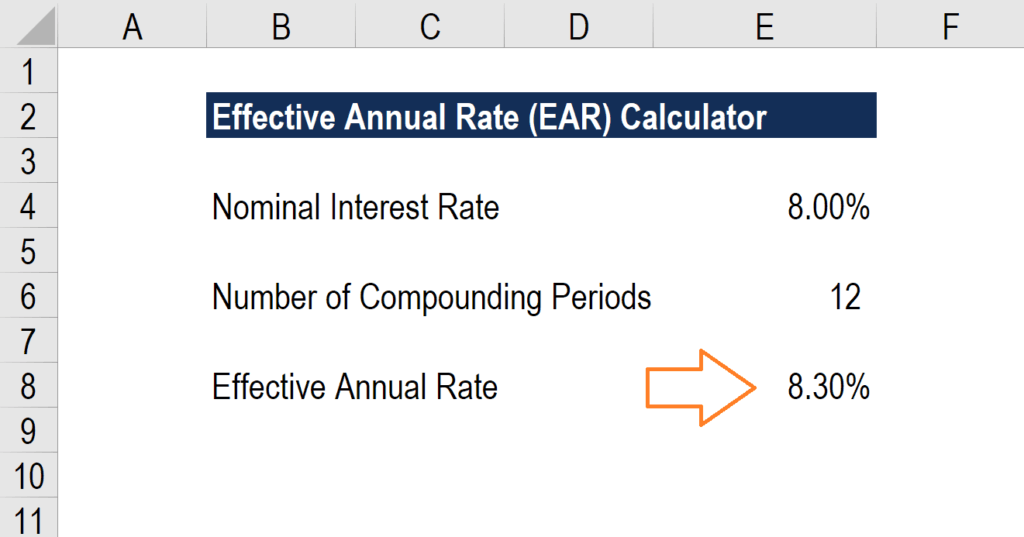

What Does Ear Mean In Finance?

EAR in finance stands for Effective Annual Rate, which reflects the actual yearly cost of funds or the interest rate on an investment, taking compounding into account.

What Is Ear Financing?

EAR financing stands for Earning Asset Ratio financing, which refers to using a company’s earning assets, such as loans or investments, to generate funding for its operations.

What Is The Difference Between Ear And Apr?

EAR, or Effective Annual Rate, factors in compounding interest throughout the year. APR, or Annual Percentage Rate, represents the yearly interest charge without compounding. EAR typically exceeds APR and provides a more accurate cost of borrowing.

How Is Ear Calculated?

EAR, or Effective Annual Rate, is calculated using the formula: \[(1 + \frac{i}{n})^n – 1\] where \(i\) represents the nominal interest rate and \(n\) is the number of compounding periods per year.

What Is Ear Finance Exactly?

Ear Finance is a financial concept or system that involves economic transactions related to auditory products and services.

Conclusion

Understanding Ear Finance is crucial in the evolving financial landscape. It’s not just a trend; it’s a significant shift in managing investments and assets. Embracing this innovation can unlock new opportunities and streamline financial processes. Keep an eye on developments within Ear Finance to stay ahead in your financial journey.