Leasing a car is like renting it long-term with the option to buy, whereas financing involves taking a loan to purchase the vehicle outright. Finance deals lead to ownership, while leases focus on use without ownership responsibilities.

Exploring the best way to acquire a new vehicle? Understanding the distinction between leasing and financing is crucial. Leasing provides access to a car for a fixed period with lower monthly payments, and there’s always a chance to switch to the latest models every few years.

On the other hand, financing a car means, after all the payments are made, the car is yours to keep. Monthly payments for financing are usually higher than leasing because you’re paying off the car’s full value. Both options have their merits, and the right choice depends on your personal preferences, financial situation, and long-term vehicle plans.

Leasing Vs. Financing: The Basics

When you need a new car or piece of equipment, you have two main choices. You can lease it or finance it. Both options let you use what you want. But they work in different ways. One might fit your needs better than the other.

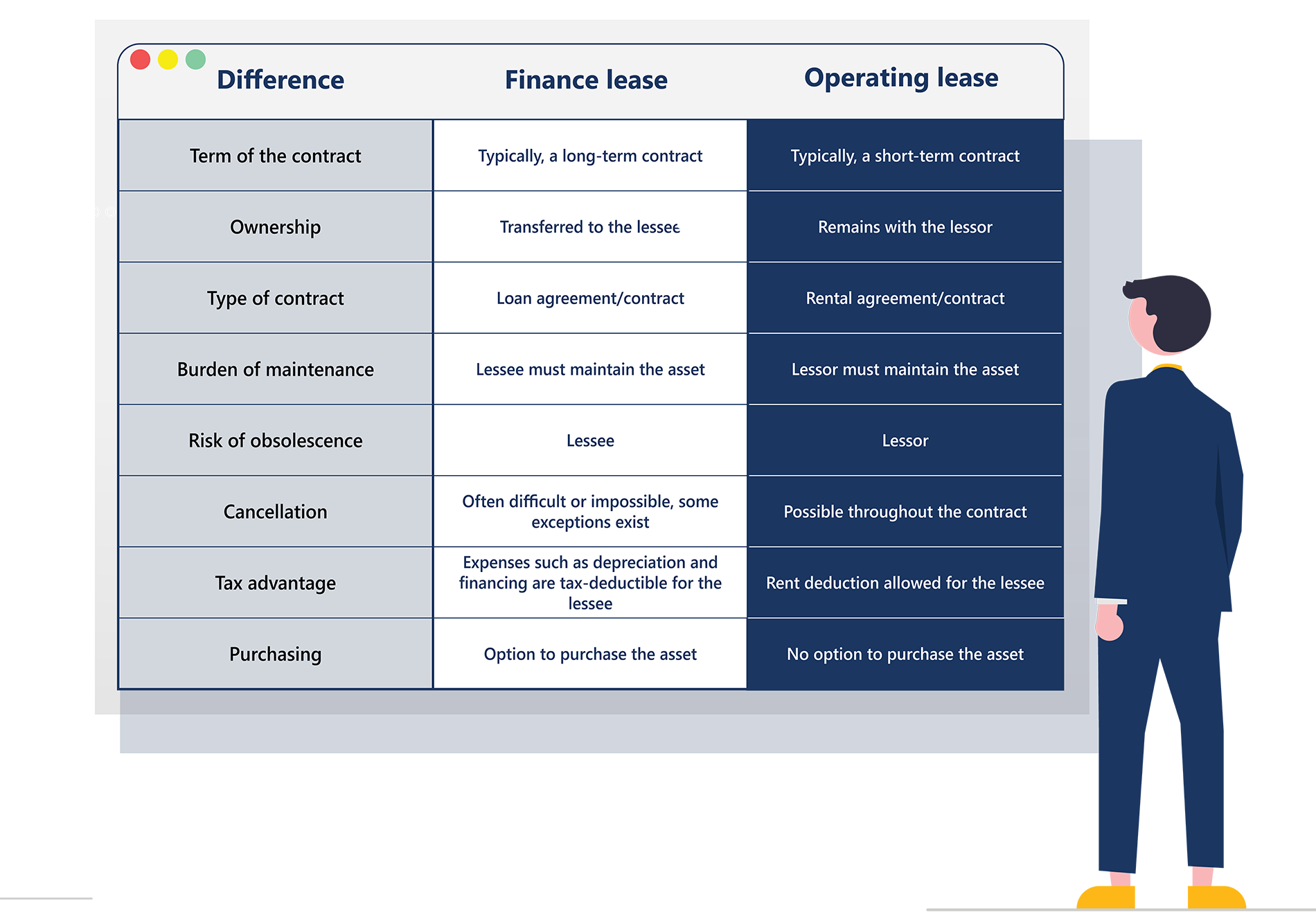

Key Differences At A Glance

Let’s look at a quick comparison:

| Lease | Finance |

|---|---|

| Rent for a time | Own after paying |

| Lower payments | Higher payments |

| Give back at end | Yours to keep |

| Less customization | Make it your own |

Terminology Brief: Lease And Finance

It helps to understand the words we use:

- Leasing means using something for a while. You pay each month. You don’t own it.

- Financing is when you get a loan to buy something. You pay over time. In the end, it’s yours.

Paying For Your Car: Lease Explained

Choosing the right way to pay for a car can be tricky. Each option has rules, benefits, and drawbacks. Leasing a car is like renting it. You don’t own it, but you use it for a while. In this section, let’s understand what leasing is and how it can affect your wallet and driving experience.

How Leasing Works

Leasing a car involves paying to use the vehicle for a set time. You agree to a contract which outlines a fixed period, often 2-4 years. During this period, you make monthly payments. At the end of the lease, return the car. Sometimes, you can choose to buy it.

Pros And Cons Of Leasing

Leasing has benefits and downsides. The right choice depends on your needs and car use habits. Here are the key points:

| Pros of Leasing | Cons of Leasing |

|---|---|

|

|

The Path Of Financing: What It Entails

Exploring the world of car ownership often leads buyers down the path of financing. Unlike leasing, financing a car means setting the groundwork for full ownership, step by step. This journey is not just about paying for a car over time—it’s about investing in a long-term asset.

Mechanics Of Auto Financing

Auto financing unravels the complexities of purchasing a vehicle over time. Buyers sign an agreement with a lender to pay for the car in installments. The contract outlines the loan amount, interest rate, and payment schedule. The lender then pays the car’s full price to the dealer, and buyers gradually repay the lender, typically over several years.

Credit scores play a crucial role in this process. They affect the interest rates a buyer qualifies for. A higher credit score generally leads to lower interest rates, reducing the overall cost.

Benefits And Downsides Of Financing

- Equity Building: With each payment, owners build equity in their vehicle.

- No Mileage Restrictions: Unlike leases, financing doesn’t impose mileage limits. Drive as much as needed.

- Customization Freedom: Owners can modify their cars to their liking, making them unique.

- Potential Benefits at Resale: If the car holds its value, there might be financial gain upon selling it.

However, there are drawbacks to consider:

- Depreciation: Cars lose value quickly, and owners might owe more than the car’s worth initially.

- Long-Term Commitment: Financing contracts can last many years, making this a long-term financial responsibility.

- Higher Overall Cost: Interest and loan fees increase the total amount paid for the vehicle.

Credit: binarystream.com

Financial Implications Over Time

Understanding the financial implications over time is crucial when choosing between leasing and financing a vehicle. Costs that appear budget-friendly today might lead to more expenses or savings in the future. Let’s break down the differences and what they mean for your wallet as time goes on.

Long-term Costs Of Leasing Vs. Financing

When deciding whether to lease or finance a car, think about long-term costs. Leasing can seem cheaper due to lower monthly payments. Yet it may cost more in the end. Consider this:

- Leasing: Shorter-term commitments with potential for ongoing payments if you choose to lease again.

- Financing: Higher monthly payments, but you stop paying once the vehicle is paid off.

Financing can lead to owning an asset free and clear, while leasing may involve perpetual payments with no ownership stake.

Ownership And Equity Considerations

Owning a vehicle leads to building equity. Financing a car means it’s yours after you pay it off. Leasing, on the other hand, never gives you ownership. Here’s a quick comparison of both options:

| Financing | Leasing |

|---|---|

| Build equity over time | No equity, it’s like renting |

| Car is yours at end of term | Return car or buy it at end of term |

| No restrictions on usage | Mileage and customization limits |

So, consider your long-term financial goals. Do you prefer building ownership over time, or do you enjoy driving a new car every few years?

Breaking Down The Fine Print

Understanding the details in a contract can be tough. Whether you decide to lease or finance your next car, the fine print holds the key to your decision. It covers everything from how long you’ll commit to your vehicle to how much you can drive it. Let’s dig into those details and make them easier to grasp.

Contract Terms And Obligations

When you sign a lease or finance agreement, you’re bound by its terms.

Lease agreements usually last for 2 to 4 years. You’ll return the car after the lease is up. Financing terms can stretch up to 7 years. You own the car at the end of your payments.

| Lease | Finance |

|---|---|

| Short-term commitment | Long-term commitment |

| Return vehicle at end | Own vehicle at end |

Mileage Limits, Wear And Tear, And Customizations

Lease agreements often come with a mileage cap. Going over this limit can lead to extra charges. Typically, you’re allowed 10,000 to 15,000 miles per year. In leasing, the car must be kept in good condition, with normal wear and tear only. Most leases also restrict customizations to the vehicle.

With financing, the car is yours to drive as much as you like. There are no mileage limits. You can also customize your car any way you want. Wear and tear only affects your car’s resale value, not your wallet.

- Lease: Mileage limits, penalties for excess wear and no customizations.

- Finance: No mileage cap, customize freely, you handle wear costs.

Credit: blog.netgain.tech

Making The Choice: Which Is Better For You?

Welcome to our practical guide on making the key decision between leasing and financing a vehicle. The right choice can significantly impact your wallet and way of life. Consider the following to determine which option aligns best with your personal circumstances.

Lifestyle And Financial Position

Lifestyle preferences and financial standing play pivotal roles in this decision. Here are factors to ponder:

- Driving habits: Assess how much you drive. Leasing usually includes mileage limits.

- Customization: If personal touches to your ride are important, financing might be the way to go.

- Vehicle ownership: Consider whether long-term ownership or switching cars frequently suits you better.

- Budget: Evaluate your monthly cash flow. Leases often require lower monthly payments.

- Credit score: A good credit score can secure favorable terms, be it lease or finance.

Case Scenarios: When To Lease Or Finance

Different scenarios can sway your choice between leasing and financing. Here’s a quick rundown:

| Scenario | Lease | Finance |

|---|---|---|

| Short-term user | Better | Less Ideal |

| High mileage driver | Less Ideal | Better |

| Fixed budget | Better | Less Ideal |

| Long-term investment | Less Ideal | Better |

| Trend follower | Better | Less Ideal |

Short-term users looking to change cars every few years should consider leasing. Drivers clocking high mileage may prefer the unlimited distance of financing.

Those on a fixed budget might find the predictable costs of a lease more appealing. If you’re eyeing a long-term investment in a car, financing will be the proper route.

Lastly, if you always want the latest model, a lease provides that flexibility with ease.

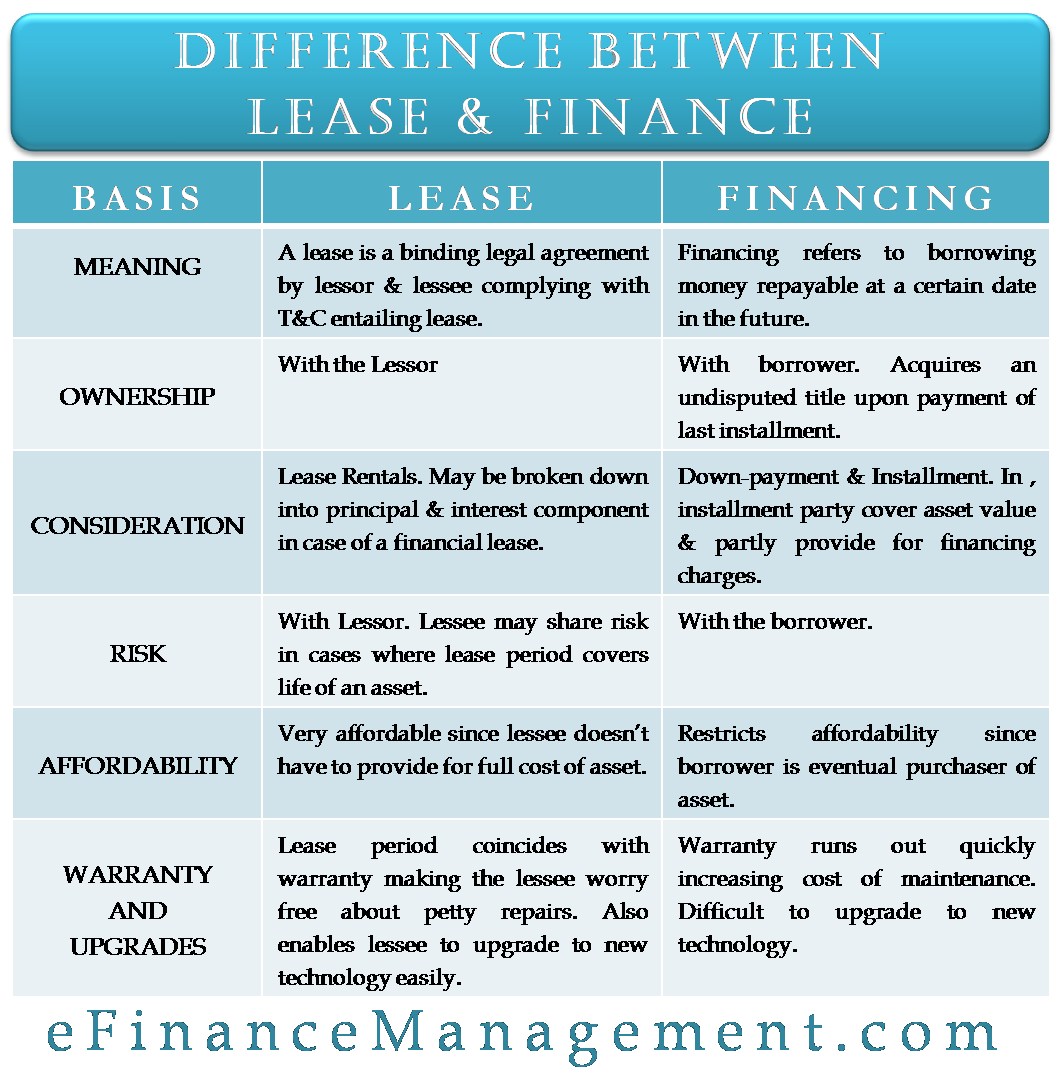

Credit: efinancemanagement.com

Frequently Asked Questions For What Is The Difference Between Lease And Finance

Is It Better To Finance Or Lease?

Choosing between financing and leasing depends on your priorities. Financing leads to ownership, ideal for long-term cost savings. Leasing offers lower payments and flexibility, suited for those who prefer new models frequently. Consider personal financial goals and driving habits to decide.

Why Leasing A Car Is Smart?

Leasing a car offers lower monthly payments and minimal upfront costs. It provides access to the latest models and technology every few years. Warranty coverage reduces maintenance concerns.

What Is The Downside Of Leasing A Vehicle?

Leasing a vehicle can lead to mileage limits, potential penalty fees, and no ownership equity. You’re subject to wear and tear charges and can face costly termination fees if you end the lease early.

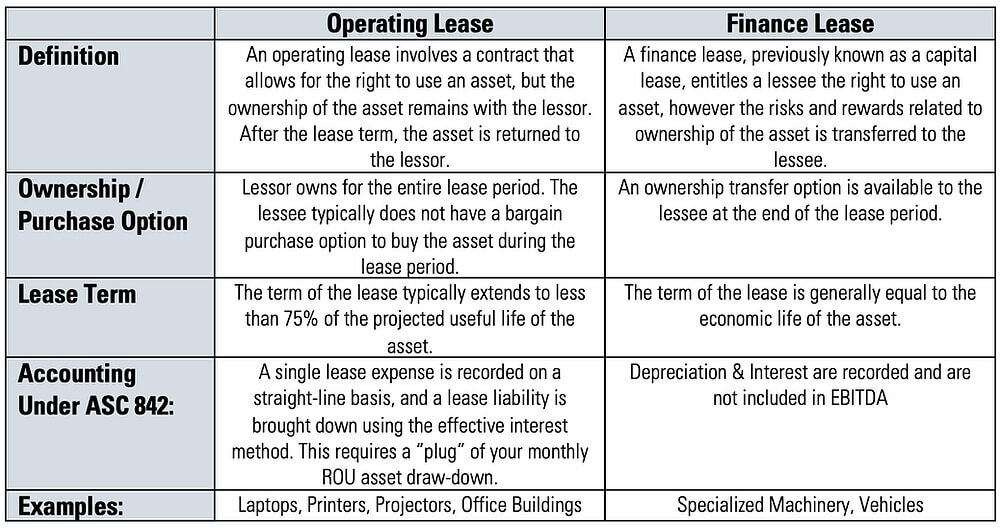

What Is The Difference Between Leasing And Financing In Business?

Leasing involves renting an asset, while financing refers to buying it with a loan. Leasing generally requires lower upfront costs and offers tax benefits, but financing leads to asset ownership after loan repayment.

What Defines A Car Lease?

Leasing a car involves a contractual agreement where one pays to use a vehicle for a set period, typically with monthly payments and mileage limits.

Conclusion

Understanding the key differences between leasing and financing is crucial when choosing your best path to vehicle ownership. Each choice offers distinct advantages tailored to individual needs and financial situations. By carefully considering your budget, driving habits, and long-term goals, you can confidently decide whether to lease or finance your next car.

Navigate your options wisely, and happy motoring!